Business, 27.05.2021 04:50 patelandrew816

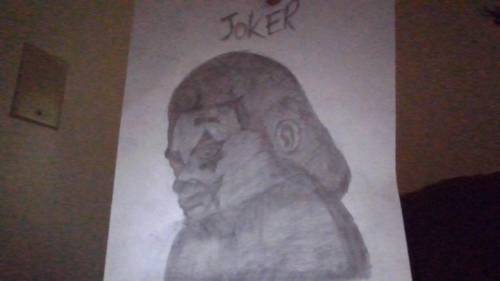

i need more votes. ive been drawing for a while and need more opinions. should i enter a drawing contest or not. let me know wht u think down below

Answers: 3

Another question on Business

Business, 22.06.2019 08:30

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

Business, 22.06.2019 12:10

Profits from using currency options and futures.on july 2, the two-month futures rate of the mexican peso contained a 2 percent discount (unannualized). there was a call option on pesos with an exercise price that was equal to the spot rate. there was also a put option on pesos with an exercise price equal to the spot rate. the premium on each of these options was 3 percent of the spot rate at that time. on september 2, the option expired. go to the oanda.com website (or any site that has foreign exchange rate quotations) and determine the direct quote of the mexican peso. you exercised the option on this date if it was feasible to do so. a. what was your net profit per unit if you had purchased the call option? b. what was your net profit per unit if you had purchased the put option? c. what was your net profit per unit if you had purchased a futures contract on july 2 that had a settlement date of september 2? d. what was your net profit per unit if you sold a futures contract on july 2 that had a settlement date of september 2

Answers: 1

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 20:00

Describe a real or made-up but possible example of a situation where an employee faces a conflict of interest. explain at least two things the company could do to make sure the employee won't be tempted into unethical behavior by that conflict of interest. (3.0 points)

Answers: 3

You know the right answer?

i need more votes. ive been drawing for a while and need more opinions. should i enter a drawing con...

Questions

Mathematics, 11.02.2021 19:30

Mathematics, 11.02.2021 19:30

Mathematics, 11.02.2021 19:30

Chemistry, 11.02.2021 19:30

English, 11.02.2021 19:30

Biology, 11.02.2021 19:30

French, 11.02.2021 19:30