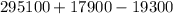

Current information for the Stellar Corporation follows: Beginning work in process inventory $ 17,900 Ending work in process inventory 19,300 Direct materials used 147,000 Direct labor used 85,000 Total factory overhead 63,100 Stellar Corporation's cost of goods manufactured for the year is:

Answers: 1

Another question on Business

Business, 22.06.2019 15:00

Ineed this asap miguel's boss asks him to distribute information to the entire staff about a mandatory meeting. in 1–2 sentences, describe what miguel should do.

Answers: 1

Business, 22.06.2019 18:00

Large public water and sewer companies often become monopolies because they benefit from although the company faces high start-up costs, the firm experiences average production costs as it expands and adds more customers. smaller competitors would experience average costs and would be less

Answers: 1

Business, 23.06.2019 14:30

Anew japanese restaurant opens two blocks from your home. the owner, reiko, is a personal friend of yours. you don't particularly like japanese food, but you decide to go anyway; however, there is nothing on the menu that sounds appealing. unfortunately, it turns out that most of the people in your town don't like japanese cuisine either. reiko confides that business is not good, but she isn't sure what to do from an economic standpoint. which of the following would most likely describe adam smith's perspective on this problem? select one: a. reiko should ask the government for assistance. b. reiko should close the restaurant and find a different career. c. reiko should lay off workers and do everything herself to save money. d. reiko should add other foods to the menu and offer discounts to attract more people to her restaurant.

Answers: 1

Business, 23.06.2019 16:00

The expenditures and receipts below are related to land, land improvements, and buildings acquired for use in a business enterprise. the receipts are enclosed in parentheses. money borrowed to pay building contractor (signed a note) $(276,500 ) (b) payment for construction from note proceeds 276,500 (c) cost of land fill and clearing 11,220 (d) delinquent real estate taxes on property assumed by purchaser 8,340 (e) premium on 6-month insurance policy during construction 12,060 (f) refund of 1-month insurance premium because construction completed early (2,010 ) (g) architect’s fee on building 27,040 (h) cost of real estate purchased as a plant site (land $206,800 and building $55,900) 262,700 (i) commission fee paid to real estate agency 9,620 (j) installation of fences around property 4,030 (k) cost of razing and removing building 10,130 (l) proceeds from salvage of demolished building (4,910 ) (m) interest paid during construction on money borrowed for construction 13,700 (n) cost of parking lots and driveways 17,690 (o) cost of trees and shrubbery planted (permanent in nature) 14,080 (p) excavation costs for new building 2,950 identify each item by letter and list the items in columnar form.

Answers: 1

You know the right answer?

Current information for the Stellar Corporation follows: Beginning work in process inventory $ 17,90...

Questions

History, 06.03.2020 15:47

Social Studies, 06.03.2020 15:47

History, 06.03.2020 15:47

Computers and Technology, 06.03.2020 15:47

($)

($)

($)

($)