Business, 21.05.2021 17:40 rockyroad19

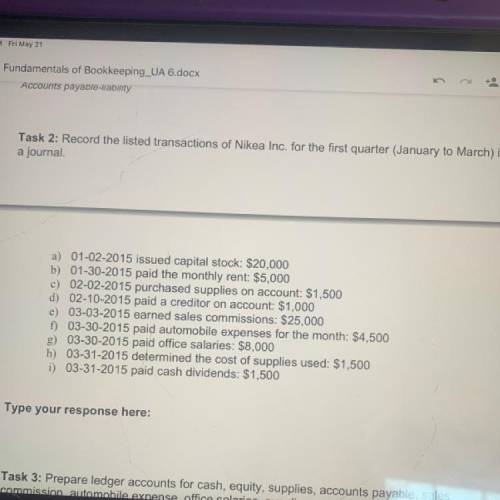

Task 2: Record the listed transactions of Nikea Inc. for the first quarter (January to March) in

a journal.

a) 01-02-2015 issued capital stock: $20,000

b) 01-30-2015 paid the monthly rent: $5,000

c) 02-02-2015 purchased supplies on account: $1,500

d) 02-10-2015 paid a creditor on account: $1,000

e) 03-03-2015 earned sales commissions: $25,000

f) 03-30-2015 paid automobile expenses for the month: $4,500

g) 03-30-2015 paid office salaries: $8,000

h) 03-31-2015 determined the cost of supplies used: $1,500

i) 03-31-2015 paid cash dividends: $1,500

Answers: 3

Another question on Business

Business, 21.06.2019 15:00

The media specialist suggests a library reading program that will correlate highly with the teaching program and reward the students as they read. the rewards will be provided by the business community. a pencil carrier will be the reward for having read 25 books, a baseball cap the reward for having read 30 books, a tee shirt for 50 books, and a backpack for having read 100 books. the media specialist's suggestion is based on her knowledge that:

Answers: 1

Business, 22.06.2019 11:00

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 1

Business, 22.06.2019 13:10

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

Business, 22.06.2019 15:30

In 2015, lori assigned a paid-up whole life insurance policy to an irrevocable life insurance trust (ilit) for the benefit of her three children. the ilit contained a crummey provision for the benefit of each child. at the time of the transfer, the whole life insurance policy was valued at $200,000, and since lori had not made any other taxable gifts during her lifetime, she did not owe any gift tax. lori died in 2016, and the face value of the whole life insurance policy of $2,000,000 was paid to the ilit. regarding this transfer, how much is included in lori’s gross estate at her death?

Answers: 1

You know the right answer?

Task 2: Record the listed transactions of Nikea Inc. for the first quarter (January to March) in

a...

Questions

Spanish, 19.10.2019 14:50

Social Studies, 19.10.2019 14:50

Geography, 19.10.2019 15:00

Biology, 19.10.2019 15:00

Biology, 19.10.2019 15:00

Mathematics, 19.10.2019 15:00

English, 19.10.2019 15:00

Mathematics, 19.10.2019 15:00

Mathematics, 19.10.2019 15:00

Mathematics, 19.10.2019 15:00