Business, 19.05.2021 19:10 ilovebeanieboos

Thornton Industries began construction of a warehouse on July 1, 2021. The project was completed on March 31, 2022. No new loans were required to fund construction. Thornton does have the following two interest-bearing liabilities that were outstanding throughout the construction period:

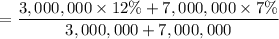

$3,000,000, 12% note

$7,000,000, 7% bonds

Construction expenditures incurred were as follows:

July 1, 2021 $ 700,000

September 30, 2021 990,000

November 30, 2021 990,000

January 30, 2022 930,000

The company’s fiscal year-end is December 31.

Required:

Calculate the amount of interest capitalized for 2021 and 2022.

Calculate the amount of interest capitalized for 2021. (Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (i. e. 0.123 should be entered as 12.3%).)

Date Expenditure Weight Average

July 1, 2021 x =

September 30, 2021 x =

November 30, 2021 x =

Accumulated expenditures

Amount Interest Rate Capitalized Interest

Average accumulated expenditures x % x =

2021

Date Expenditure Weight Average

January 1, 2022 x =

January 30, 2022 x =

Amount Interest Rate Capitalized Interest

Average accumulated expenditures x x =

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Andrew cooper decides to become a part owner of a corporation. as a part owner, he expects to receive a profit as payment because he has assumed the risk of - serious inflation eroding the purchasing power of his investment.- being paid before the suppliers and employees are paid.- losing his home, car, and life savings.- losing the money he has invested in the corporation and not receiving profits.- the company giving all of the profits to local communities

Answers: 2

Business, 22.06.2019 07:10

Walsh company manufactures and sells one product. the following information pertains to each of the company’s first two years of operations: variable costs per unit: manufacturing: direct materials $ 25 direct labor $ 12 variable manufacturing overhead $ 5 variable selling and administrative $ 4 fixed costs per year: fixed manufacturing overhead $ 400,000 fixed selling and administrative expenses $ 60,000 during its first year of operations, walsh produced 50,000 units and sold 40,000 units. during its second year of operations, it produced 40,000 units and sold 50,000 units. the selling price of the company’s product is $83 per unit. required: 1. assume the company uses variable costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 2. assume the company uses absorption costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 3. reconcile the difference between variable costing and absorption costing net operating income in year 1.

Answers: 3

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Business, 22.06.2019 19:10

After the price floor is instituted, the chairman of productions office buys up any barrels of gosum berries that the producers are not able to sell. with the price floor, the producers sell 300 barrels per month to consumers, but the producers, at this high price floor, produce 700 barrels per month. how much producer surplus is created with the price floor? show your calculations.

Answers: 2

You know the right answer?

Thornton Industries began construction of a warehouse on July 1, 2021. The project was completed on...

Questions

Physics, 28.11.2020 19:40

Mathematics, 28.11.2020 19:40

Physics, 28.11.2020 19:40

Mathematics, 28.11.2020 19:50

Health, 28.11.2020 19:50

Biology, 28.11.2020 19:50

Physics, 28.11.2020 19:50

Social Studies, 28.11.2020 19:50

Mathematics, 28.11.2020 19:50

Mathematics, 28.11.2020 19:50

Medicine, 28.11.2020 19:50

English, 28.11.2020 19:50