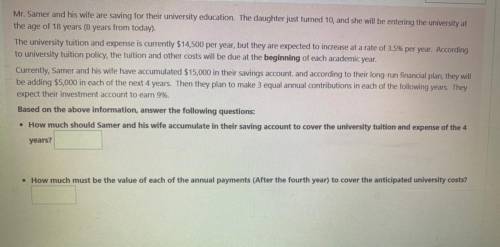

Mr. Samer and his wife are saving for their university education. The daughter just turned 10, and she will be entering the university at

the age of 18 years (8 years from today).

The university tuition and expense is currently $14,500 per year, but they are expected to increase at a rate of 3.5% per year. According

to university tuition policy, the tuition and other costs will be due at the beginning of each academic year.

Currently, Samer and his wife have accumulated $15,000 in their savings account and according to their long-run financial plan, they will

be adding $5,000 in each of the next 4 years. Then they plan to make 3 equal annual contributions in each of the following years. They

expect their investment account to earn 9%.

Based on the above information, answer the following questions:

• How much should Samer and his wife accumulate in their saving account to cover the university tuition and expense of the 4

years?

• How much must be the value of each of the annual payments (After the fourth year) to cover the anticipated university costs?

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

As a group is leaving, you ask them if they had a good experience at the restaurant. they mention that they had poor service and their food was cold. a.apologize and ask them to give the restaurant another chance in the future. you tell them that guests usually have a great experience here. b.apologize then ask for the server’s name and immediately notify the manager after they leave. c.apologize for the bad experience and ask them to wait as you call the manager to talk to them. d.apologize for the bad experience and encourage them to complete the customer service survey. this feedback will ensure other guests do not have the same experience.

Answers: 2

Business, 22.06.2019 14:40

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate.the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received.c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

Business, 22.06.2019 23:10

Which of the following best explains the purpose of a strike? a. to pressure employers to increase the minimum wage. b. to make sure that producers don't make any profit. c. to get employers to submit to collective bargaining. d. to prevent employers from taking industrial action.

Answers: 2

You know the right answer?

Mr. Samer and his wife are saving for their university education. The daughter just turned 10, and s...

Questions

French, 18.03.2021 20:30

World Languages, 18.03.2021 20:30

Mathematics, 18.03.2021 20:30

Mathematics, 18.03.2021 20:30

English, 18.03.2021 20:30

Mathematics, 18.03.2021 20:30

Physics, 18.03.2021 20:30

Mathematics, 18.03.2021 20:30

Mathematics, 18.03.2021 20:30

World Languages, 18.03.2021 20:30