Business, 07.05.2021 09:30 lakenyahar

BRYCE: Has a high paying job and has determined he could afford up to $2700 per month

Wants a sweet home to reward all his hard work; his dream home costs $550,000

Has been sloppy in the past with his bill pay, leading to a credit score of 670, so the best rate he can get is 4.26% for 30 years fixed

Is willing to contribute $75,000 to his down payment

How much, per month, is Bryce short on the mortgage payments for his dream home?

$

How much would Bryce’s down payment need to be if he wanted to get his monthly payments down to $2,500 or slightly under?

Using this strategy, how much total interest would he pay over the course of the loan?

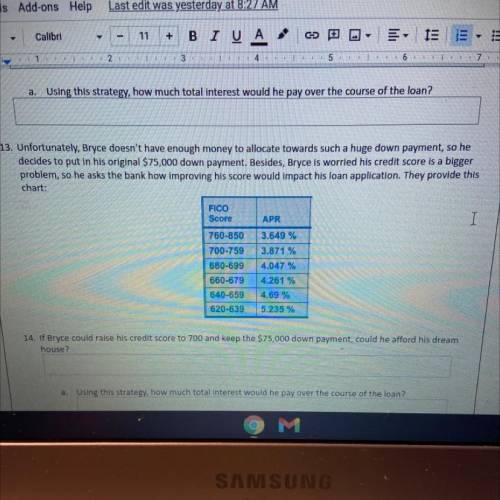

Unfortunately, Bryce doesn’t have enough money to allocate towards such a huge down payment, so he decides to put in his original $75,000 down payment. Besides, Bryce is worried his credit score is a bigger problem, so he asks the bank how improving his score would impact his loan application. They provide this chart:

If Bryce could raise his credit score to 700 and keep the $75,000 down payment, could he afford his dream house? (760-850 = 3.649%, 700-759 = 3.871%, 680-699 = 4.047%, 660-679 = 4.261%, 640-659 = 4.69%, 620-639 = 5.235%)

Using this strategy, how much total interest would he pay over the course of the loan?

What do you think Bryce should do?

Answers: 2

Another question on Business

Business, 21.06.2019 18:00

You want to make an investment in a continuously compounding account over a period of two years. what interest rate is required for your investment to double in that time period? round the logarithm value and the answer to the nearest tenth.

Answers: 3

Business, 21.06.2019 22:30

Acompany determined that the budgeted cost of producing a product is $30 per unit. on june 1, there were 80,000 units on hand, the sales department budgeted sales of 300,000 units in june, and the company desires to have 120,000 units on hand on june 30. the budgeted cost of goods sold for june would be

Answers: 1

Business, 22.06.2019 05:10

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 15:00

Beagle autos is known for its affordable and reliable brand of consumer vehicles. because its shareholders expect to see an improved rate of growth in the coming years, beagle's executives have decided to diversify the company's range of products so that at least 40 percent of the firm's revenue is generated by new business units. however, the company's resources, capabilities, and competencies are limited to producing other forms of motorized vehicles, such as motorcycles and all-terrain vehicles (atvs). which type of corporate diversification strategy should beagle pursue?

Answers: 1

You know the right answer?

BRYCE: Has a high paying job and has determined he could afford up to $2700 per month

Wants a swee...

Questions

Mathematics, 10.02.2020 03:36

Mathematics, 10.02.2020 03:36

Mathematics, 10.02.2020 03:36

Mathematics, 10.02.2020 03:37

Law, 10.02.2020 03:37

Mathematics, 10.02.2020 03:37

Mathematics, 10.02.2020 03:37

Mathematics, 10.02.2020 03:38

History, 10.02.2020 03:38

Mathematics, 10.02.2020 03:38

English, 10.02.2020 03:38