Business, 28.09.2019 06:30 cuppykittyy

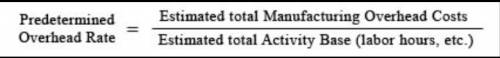

Jonathan mfg. adopted a job? costing system. for the current year, budgeted cost driver activity levels for direct labor hours and direct labor costs were 20,000 and $100,000, respectively. in addition, budgeted variable and fixed factory overhead were $50,000 and $25,000, respectively. actual costs and hours for the year were as follows: direct labor hours 21,000 direct labor costs $110,000 machine hours 35,000 for a particular job, 1,500 direct labor hours were used. using direct labor hours as the cost driver, what amount of overhead should be applied to this job?

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

What is the relationship between marginal external cost, marginal social cost, and marginal private cost? a. marginal social cost equals marginal private cost plus marginal external cost. b. marginal private cost plus marginal social cost equals marginal external cost. c. marginal social cost plus marginal external cost equals marginal private cost. d. marginal external cost equals marginal private cost minus marginal social cost. marginal external cost a. is expressed in dollars, so it is not an opportunity cost b. is an opportunity cost borne by someone other than the producer c. is equal to two times the marginal private cost d. is a convenient economics concept that is not real

Answers: 3

Business, 22.06.2019 04:30

The lee family is looking to buy a house in one of two suburban areas just outside of a major city, and air quality is a top priority for them. overall air quality is calculated by taking measures in 100 locations within each suburb and then calculating a measure of central tendency. in one suburb, there is a major bus station that creates very poor air quality at its location but has no impact in the surrounding parts of the suburb. in this situation, which measure of overall suburb air quality would be most useful?

Answers: 3

Business, 22.06.2019 11:20

Mae jong corp. issues $1,000,000 of 10% bonds payable which may be converted into 10,000 shares of $2 par value ordinary shares. the market rate of interest on similar bonds is 12%. interest is payable annually on december 31, and the bonds were issued for total proceeds of $1,000,000. in accounting for these bonds, mae jong corp. will: (a) first assign a value to the equity component, then determine the liability component. (b) assign no value to the equity component since the conversion privilege is not separable from the bond.(c) first assign a value to the liability component based on the face amount of the bond.(d) use the “with-and-without” method to value the compound instrument.

Answers: 3

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

You know the right answer?

Jonathan mfg. adopted a job? costing system. for the current year, budgeted cost driver activity lev...

Questions

Mathematics, 23.09.2021 23:20

Mathematics, 23.09.2021 23:20

Health, 23.09.2021 23:20

Social Studies, 23.09.2021 23:20

History, 23.09.2021 23:20

Social Studies, 23.09.2021 23:20

History, 23.09.2021 23:20

English, 23.09.2021 23:20