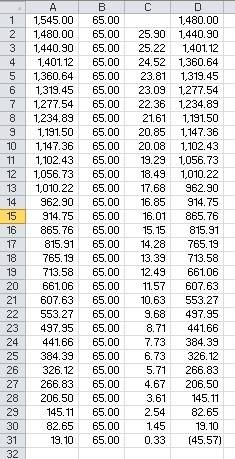

Patty took a cash advance of $1,500. her new credit card charges an annual percentage rate of 21%. the transaction fee for the cash advance is 3% of the amount of the advance, with a minimum fee of $35. this fee is added to the total cash advance, and accrues interest. if patty makes monthly payments of $65: how many months will it take patty to pay for the cash advance?

Answers: 3

Another question on Business

Business, 21.06.2019 20:40

Which of the following actions is most likely to result in a decrease in the money supply? a. the discount rate on overnight loans is lowered. b. the government sells a new batch of treasury bonds. c. the federal reserve bank buys treasury bonds. d. the required reserve ratio for banks is decreased. 2b2t

Answers: 2

Business, 21.06.2019 22:30

True or false: banks are required to make electronically deposited funds available on the same day of the deposit

Answers: 2

Business, 21.06.2019 23:10

You are the new chief information officer for the video-game developer, necturus games. the company has recently undergone a major expansion of its primary product, and you must staff up the is department and determine the best way to develop new game "capsules" for the game, "escape velocity."

Answers: 1

Business, 22.06.2019 04:00

Which law would encourage more people to become homeowners but not encourage risky loans that could end in foreclosure? options: offering first time homebuyers tax-free accounts to save for down payments requiring all mortgages to be more affordable, interest-only loans outlawing home inspections and appraisals by mortgage companies limiting rent increases to less than 2% a year

Answers: 2

You know the right answer?

Patty took a cash advance of $1,500. her new credit card charges an annual percentage rate of 21%. t...

Questions

English, 01.07.2021 08:20

Mathematics, 01.07.2021 08:20

Mathematics, 01.07.2021 08:20

Mathematics, 01.07.2021 08:20

Chemistry, 01.07.2021 08:20

Mathematics, 01.07.2021 08:20

Physics, 01.07.2021 08:20

Chemistry, 01.07.2021 08:20

Mathematics, 01.07.2021 08:20

World Languages, 01.07.2021 08:20

English, 01.07.2021 08:20

Biology, 01.07.2021 08:20