Business, 29.09.2019 16:30 mermaid1304

About 100 million pounds of jelly beans are consumed in the united stats each year, and the price has been about 50 cents per pound. however, jelly bean producers feel that their incomes are too low and have convinced the government that price supports are in order. specifically, the government has agreed to buy up as many jelly beans as necessary to keep the price at $1 per pound. however, government economists are worried about the impact of this program because they have no estimates of the elasticities of jelly bean supply or demand.

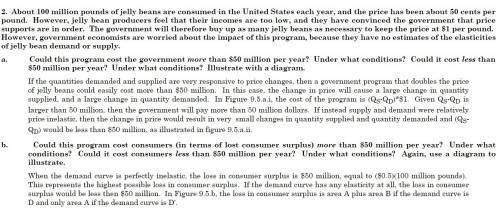

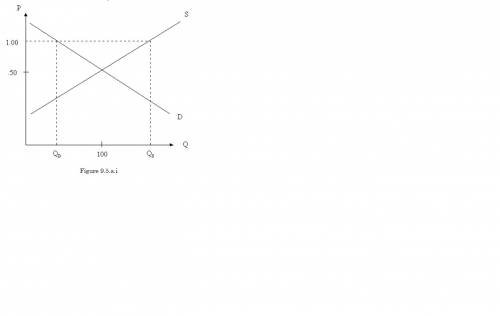

a. could this program cost the government more than $50 million per year? under

what conditions? illustrate with a diagram.

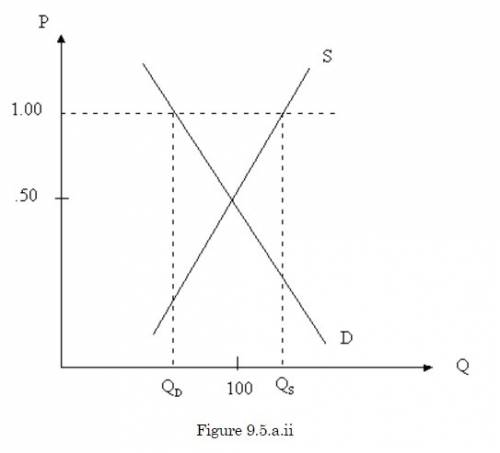

b. could this program cost consumers in terms of lost consumer surplus more that $50 million? under what conditions? again, illustrate with a diagram.

Answers: 1

Another question on Business

Business, 22.06.2019 12:50

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. consider all factors that affect the yield curve. then identify which of the following shapes that the u.s. treasury yield curve can take. check all that apply.

Answers: 2

Business, 22.06.2019 15:20

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

Business, 22.06.2019 16:20

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

Business, 22.06.2019 16:40

Consider two similar industries, portal crane manufacturing (pcm) and forklift manufacturing (flm). the pcm industry has exactly three incumbents with annual sales of $800 million, $200 million and $100 million, respectively. the flm industry has also exactly three incumbents, with annual sales of $500 million, $450 million and $400 million, respectively. which industry is more likely to experience a higher level of rivalry?

Answers: 3

You know the right answer?

About 100 million pounds of jelly beans are consumed in the united stats each year, and the price ha...

Questions

Spanish, 02.02.2020 12:47

Arts, 02.02.2020 12:47

Mathematics, 02.02.2020 12:47

Mathematics, 02.02.2020 12:47

Biology, 02.02.2020 12:47

Physics, 02.02.2020 12:47

History, 02.02.2020 12:47

History, 02.02.2020 12:47

Advanced Placement (AP), 02.02.2020 12:47

Mathematics, 02.02.2020 12:47

Mathematics, 02.02.2020 12:47

Mathematics, 02.02.2020 12:47