1

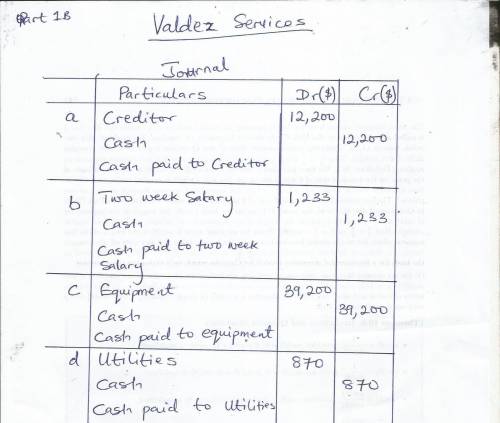

following are the transactions for valdez services.

following are the transactions fo...

Business, 25.08.2019 20:00 ruffnekswife

1

following are the transactions for valdez services.

following are the transactions for valdez services.

a.

the company paid $12,200 cash for payment on a 16-month old liability for office supplies.

b.

the company paid $1,233 cash for the just completed two-week salary of the receptionist.

c.

the company paid $39,200 cash for equipment purchased.

d.

the company paid $870 cash for this month's utilities.

e.

owner (valdez withdrew $4,500 cash from the company for personal use.

examine the above transactions and

1

following are the transactions for valdez services.

following are the transactions for valdez services.

a.

the company paid $12,200 cash for payment on a 16-month old liability for office supplies.

b.

the company paid $1,233 cash for the just completed two-week salary of the receptionist.

c.

the company paid $39,200 cash for equipment purchased.

d.

the company paid $870 cash for this month's utilities.

e.

owner (valdez withdrew $4,500 cash from the company for personal use.

examine the above transactions and identify those that create expenses for valdez services. (you may select more than one answer. click the box with a check mark for correct answers and click to empty the box for the wrong answers.

transaction

a.

transaction

b.

transaction

c.

transaction

d.

transaction

e.

prepare general journal entries to record those transactions that created expenses in the above given order.

2

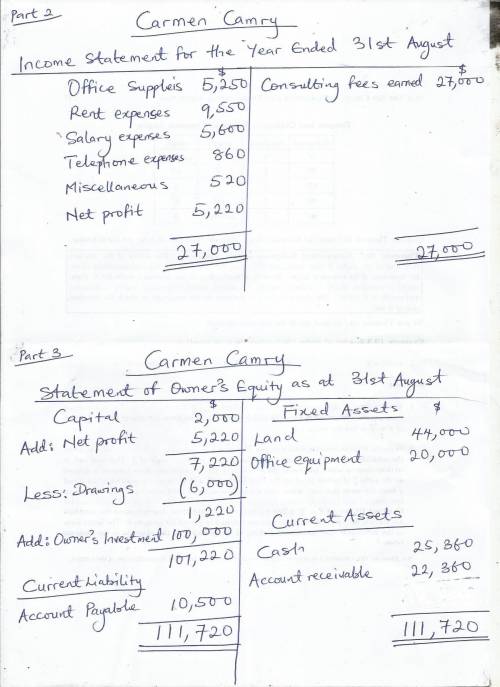

carmen camry operates a consulting firm called today. on august 31, the company's records show the following accounts and amounts for the month of august. use this information to prepare an august income statement for the business.

cash

$

25,360

c. camry, withdrawals

$

6,000

accounts receivable

22,360

consulting fees earned

27,000

office supplies

5,250

rent expense

9,550

land

44,000

salaries expense

5,600

office equipment

20,000

telephone expense

860

accounts payable

10,500

miscellaneous expense

520

c. camry, capital, july 31

2,000

owner investment made on august 4

100,000

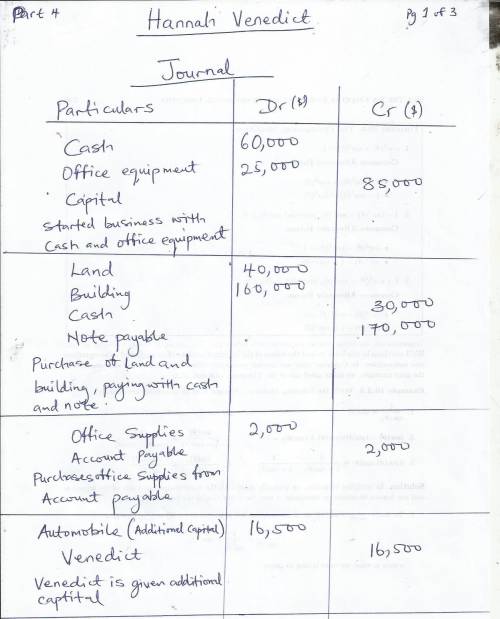

3

carmen camry operates a consulting firm called today. on august 31, the company's records show the following accounts and amounts for the month of august. use this information to prepare an august statement of owner's equity for today.

cash

$

25,360

c. camry, withdrawals

$

6,000

accounts receivable

22,360

consulting fees earned

27,000

office supplies

5,250

rent expense

9,550

land

44,000

salaries expense

5,600

office equipment

20,000

telephone expense

860

accounts payable

10,500

miscellaneous expense

520

c. camry, capital, july 31

2,000

owner investment made on august 4

100,000

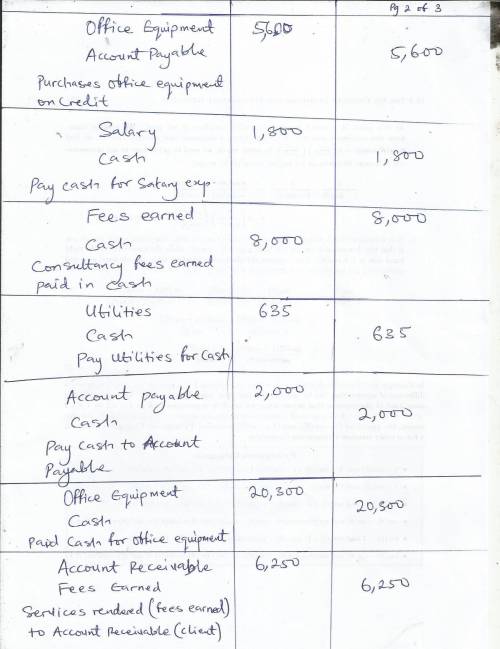

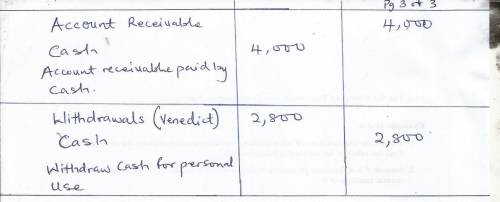

4

business transactions completed by hannah venedict during the month of september are as follows.

a.

venedict invested $60,000 cash along with office equipment valued at $25,000 in a new sole proprietorship named hv consulting.

b.

the company purchased land valued at $40,000 and a building valued at $160,000. the purchase is paid with $30,000 cash and a long-term note payable for $170,000.

c.

the company purchased $2,000 of office supplies on credit.

d.

venedict invested her personal automobile in the company. the automobile has a value of $16,500 and is to be used exclusively in the business.

e.

the company purchased $5,600 of additional office equipment on credit.

f.

the company paid $1,800 cash salary to an assistant.

g.

the company provided services to a client and collected $8,000 cash.

h.

the company paid $635 cash for this month's utilities.

i.

the company paid $2,000 cash to settle the account payable created in transaction

c.

j.

the company purchased $20,300 of new office equipment by paying $20,300 cash.

k.

the company completed $6,250 of services for a client, who must pay within 30 days.

l.

the company paid $1,800 cash salary to an assistant.

m.

the company received $4,000 cash in partial payment on the receivable created in transaction k.

n.

venedict withdrew $2,800 cash from the company for personal use.

required:

required:

1.

prepare general journal entries to record these transactions using the following titles: cash (101; accounts receivable (106; office supplies (108; office equipment (163; automobiles (164; building (170; land (172; accounts payable (201; notes payable (250; h. venedict, capital (301; h. venedict, withdrawals (302; fees earned (402; salaries expense (601; and utilities expense (602.

Answers: 1

Another question on Business

Business, 21.06.2019 17:10

Which statement describes a monopoly? many firms produce identical products with no control over the market price. many firms produce differentiated products with control over market price. a single firm produces a product with no close substitutes and control over the market price. a single firm produces a product with many close substitutes and limited control over the market price.

Answers: 1

Business, 21.06.2019 21:30

He set of companies a product goes through on the way to the consumer is called the a. economic utility b. cottage industry c. market saturation d. distribution chain

Answers: 3

Business, 21.06.2019 22:30

An annuity that goes on indefinitely is called a perpetuity. the payments of a perpetuity constitute a/an series. the equation is: a stock with no maturity is an example of a perpetuity. quantitative problem: you own a security that provides an annual dividend of $170 forever. the security’s annual return is 9%. what is the present value of this security? round your answer to the nearest cent. $

Answers: 2

Business, 22.06.2019 04:00

Medtronic, inc., is a medical technology company that competes for customers with st. jude medical s.c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic. hughes sought a position as a sales director for st. jude. st. jude told hughes that his contract with medtronic was unenforceable and offered him a job. hughes accepted. medtronic filed a suit, alleging wrongful interference. which type of interference was most likely the basis for this suit? did it occur here? medtronic, inc., is a medical technology company that competes for customers with st. jude medical s.c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic

Answers: 2

You know the right answer?

Questions

English, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

Physics, 10.12.2020 14:00

Chemistry, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

English, 10.12.2020 14:00

Chemistry, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

Mathematics, 10.12.2020 14:00

History, 10.12.2020 14:00