Business, 09.04.2021 04:10 marissasusievalles

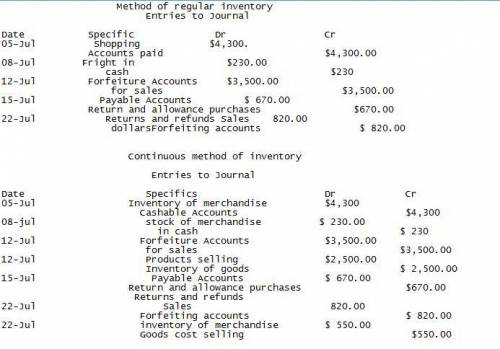

Bill Blumberg owns an auto parts business called Bill's Auto Parts. The following transactions took place during July of the current year.

July 5 Purchased merchandise on account from Wheeler Warehouse, $4,300.

8 Paid freight charge on merchandise purchased, $230.

12 Sold merchandise on account to Big Time Spoiler, $3,500. The merchandise

cost $2,500.

15 Received a credit memo from Wheeler Warehouse for merchandise, $670.

22 Issued a credit memo to Big Time Spoiler for merchandise returned, $820.

The cost of the merchandise is $550.

Required:

1. Journalize the above transactions in a general journal using the periodic inventory method.

2. Journalize the above transactions in a general journal using the perpetual inventory method.

Answers: 2

Another question on Business

Business, 22.06.2019 08:50

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

Business, 22.06.2019 10:00

Frolic corporation has budgeted sales and production over the next quarter as follows. the company has 4100 units of product on hand at july 1. 10% of the next months sales in units should be on hand at the end of each month. october sales are expected to be 72000 units. budgeted sales for september would be: july august september sales in units 41,500 53,500 ? production in units 45,700 53,800 58,150

Answers: 3

Business, 22.06.2019 15:50

Singer and mcmann are partners in a business. singer’s original capital was $40,000 and mcmann’s was $60,000. they agree to salaries of $12,000 and $18,000 for singer and mcmann respectively and 10% interest on original capital. if they agree to share remaining profits and losses on a 3: 2 ratio, what will mcmann’s share of the income be if the income for the year was $15,000?

Answers: 1

Business, 22.06.2019 17:30

Kevin and jenny, who are both working full-time, have three children all under the age of ten. the two youngest children, who are three and five years old, attended eastside pre-school for a total cost of $3,000. ervin, who is nine, attended big kid daycare after school at a cost of $2,000. jenny has earned income of $15,000 and kevin earns $14,000. what amount of childcare expenses should be used to determine the child and dependent care credit?

Answers: 3

You know the right answer?

Bill Blumberg owns an auto parts business called Bill's Auto Parts. The following transactions took...

Questions

Mathematics, 30.10.2019 19:31

Mathematics, 30.10.2019 19:31

English, 30.10.2019 19:31

Mathematics, 30.10.2019 19:31

Business, 30.10.2019 19:31

English, 30.10.2019 19:31

Geography, 30.10.2019 19:31

English, 30.10.2019 19:31