Business, 09.04.2021 04:00 PersonPerson13260

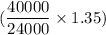

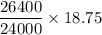

Problem 8-27A (Static) Computing standard cost and analyzing variances LO 8-5, 8-6 Spiro Company manufactures molded candles that are finished by hand. The company developed the following standards for a new line of drip candles. Amount of direct materials per candle 1.6 pounds Price of direct materials per pound $ 1.50 Quantity of labor per unit 1 hour Price of direct labor per hour $ 20 /hour Total budgeted fixed overhead $ 390,000 During Year 2, Spiro planned to produce 30,000 drip candles. Production lagged behind expectations, and it actually produced only 24,000 drip candles. At year-end, direct materials purchased and used amounted to 40,000 pounds at a unit price of $1.35 per pound. Direct labor costs were actually $18.75 per hour and 26,400 actual hours were worked to produce the drip candles. Overhead for the year actually amounted to $330,000. Overhead is applied to products using a predetermined overhead rate based on estimated units.

Answers: 3

Another question on Business

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

Business, 22.06.2019 22:20

Which of the following is one disadvantage of renting a place to live compared to buying a home? a. tenants have to pay for all repairs to the building. b. the landlord covers the expenses of maintaining the property. c. residents can't alter their living space without permission. d. rent is generally more than monthly mortgage payments.

Answers: 1

Business, 23.06.2019 02:30

Interview notes mike is 50 and made $36,000 in wages in 2017. he is single and pays all the cost of keeping up his home. mike's daughter, brittany, lived with mike all year. brittany's son, hayden, was born in november 2017. hayden lived in mike's home since birth. brittany is 25, single, and had $1,500 in wages in 2017. she is not disabled. mike provides more than half of the support for both brittany and hayden. mike, brittany, and hayden are all u.s. citizens with valid social security numbers. 4. who can mike claim as a qualifying child(ren) for the earned income credit?

Answers: 1

Business, 23.06.2019 10:00

Brody and tanya recently sold some land they owned for $150,000. they received the land five years ago as a wedding gift from brody's aunt jeanette. she had already given them cash equal to the annual exclusion during that year. aunt jeanette purchased the land many years ago when the property was worth $20,000. at the time of the gift, the property was worth $100,000 and aunt jeanette paid $47,000 in gift tax. what is the long term capital gain on the sale of the property

Answers: 3

You know the right answer?

Problem 8-27A (Static) Computing standard cost and analyzing variances LO 8-5, 8-6 Spiro Company man...

Questions

Mathematics, 15.04.2020 02:47

English, 15.04.2020 02:47

Mathematics, 15.04.2020 02:47

2.4

2.4

20

20

13

13

2.25

2.25

20.63

20.63

13.75

13.75