Business, 24.03.2021 17:00 savageyvens

Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows:

Estimated Fixed Costs Estimated Variable Cost (per unit sold)

Production costs:

Direct materials………………………………………………………………. -- $50.00

Direct labor…………………………………………………………………….. -- 30

Factory overhead……………………………………………………………. $350,000 6

Selling expenses:

Sales salaries and commissions………………………………………. 340,000 4

Advertising……………………………………………………………… ……… 116,000 --

Travel…………………………………………………………………………… … 4,000 --

Miscellaneous selling expense………………………………………… 2,300 1

Administrative expenses:

Office and officers’ salaries…………………………………………….. 325,000 --

Supplies……………………………………………………………………… ….. 6,000 4

Miscellaneous administrative expense 8,700 1

Total……………………………………………………………………………… ……………… $1,152,000 $96.00

It is expected that 12,000 units will be sold at a price of $240 a unit. Maximum sales within the relevant range are 18,000 units.

Required:

a. Prepare an estimated income statement for 2017.

b. What is the expected contribution margin ratio?

c. Determine the break-even sales in units and dollars.

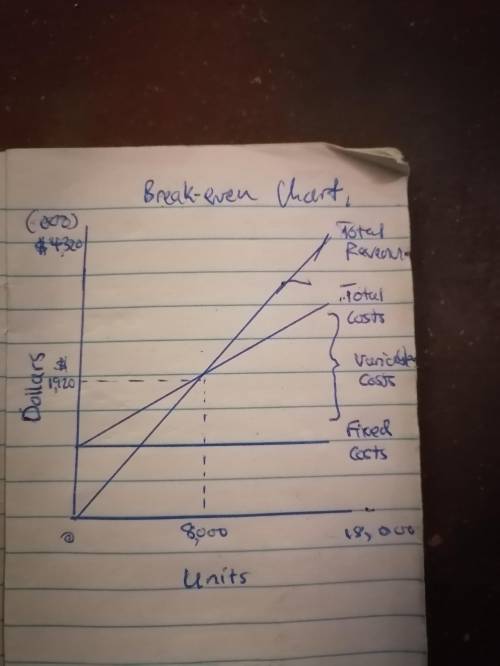

d. Construct a cost-volume-profit chart indicating the break-even sales.

e. What is the expected margin of safety in dollars and as a percentage of sales?

f. Determine the operating leverage.

Answers: 1

Another question on Business

Business, 22.06.2019 17:40

Aproduct has a demand of 4000 units per year. ordering cost is $20, and holding cost is $4 per unit per year. the cost-minimizing solution for this product is to order: ? a. 200 units per order. b. all 4000 units at one time. c. every 20 days. d. 10 times per year. e. none of the above

Answers: 3

Business, 22.06.2019 21:10

An investor purchases 500 shares of nevada industries common stock for $22.00 per share today. at t = 1 year, this investor receives a $0.42 per share dividend (which is not reinvested) on the 500 shares and purchases an additional 500 shares for $24.75 per share. at t = 2 years, he receives another $0.42 (not reinvested) per share dividend on 1,000 shares and purchases 600 more shares for $31.25 per share. at t = 3 years, he sells 1,000 of the shares for $35.50 per share and the remaining 600 shares at $36.00 per share, but receives no dividends. assuming no commissions or taxes, the money-weighted rate of return received on this investment is closest to:

Answers: 3

Business, 23.06.2019 00:00

Both renewable and nonrenewable resources are used within our society. how do the uses of nonrenewable resources compare to the uses of renewable resources?

Answers: 1

Business, 23.06.2019 00:30

Three years ago, the city of recker committed to build a park and music venue by the river. it was expected to cost $2.5 million and be paid for from an additional meals tax in the community. the residents pushed back. local restaurants suffered as people ate out less or patronized restaurants in neighboring communities. the project has stalled, but the town council kept pushing it on. this spring, a flood devastated the venue. the town council appears to have suffered from bias

Answers: 3

You know the right answer?

Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the y...

Questions

Mathematics, 23.04.2021 20:40

Arts, 23.04.2021 20:40

Mathematics, 23.04.2021 20:40

SAT, 23.04.2021 20:40

Mathematics, 23.04.2021 20:40

Mathematics, 23.04.2021 20:40

English, 23.04.2021 20:40