These are the choices fill in the blanks.

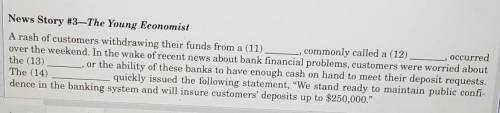

asset backed security bank run

credit default swap....

These are the choices fill in the blanks.

asset backed security bank run

credit default swap. capital

bond. credit

common stock. credit crunch

mortgage-backed securities. debt

mutual fund. default

option. equity

futures contract. foreclosure

subprime mortgage. leverage

central bank. liquidity

commercial bank. liquidity risk

hedge fund. moral hazard

investment bank. mortgage

fannie mae/ freddie mac. nationalization

federal deposit insurance corporation regulation

federal reserve system. return

private equity fund

risk

securitization

Answers: 1

Another question on Business

Business, 22.06.2019 11:10

Robert black, regional manager for ford in texas and oklahoma, faced a dilemma. the ford f-150 pickup truck was the best-selling pickup ever, yet ford's headquarters in detroit had decided to introduce a completely redesigned f-150. how could mr. black sell both trucks at the same time? he still had "old" f-150s in stock. in his advertising, mr. black referred to the new f-150s as follows: "not a better f-150. just the only truck good enough to be the next f-150." this statement represents ford's of the new f-150.

Answers: 2

Business, 22.06.2019 11:40

Select the correct answer. which is a benefit of planning for your future career? a.being less prepared after high school. b.having higher tuition in college. c.earning college credits in high school. d.ruining your chances of having a successful career.

Answers: 2

Business, 22.06.2019 16:20

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

Business, 22.06.2019 22:00

Your sister turned 35 today, and she is planning to save $60,000 per year for retirement, with the first deposit to be made one year from today. she will invest in a mutual fund that's expected to provide a return of 7.5% per year. she plans to retire 30 years from today, when she turns 65, and she expects to live for 25 years after retirement, to age 90. under these assumptions, how much can she spend each year after she retires? her first withdrawal will be made at the end of her first retirement year.

Answers: 3

You know the right answer?

Questions

Mathematics, 24.10.2020 20:30

English, 24.10.2020 20:30

Computers and Technology, 24.10.2020 20:30

Mathematics, 24.10.2020 20:30

Mathematics, 24.10.2020 20:30

English, 24.10.2020 20:30

Mathematics, 24.10.2020 20:30

Mathematics, 24.10.2020 20:30

Mathematics, 24.10.2020 20:30

Social Studies, 24.10.2020 20:30

Chemistry, 24.10.2020 20:30