Business, 20.03.2021 01:00 saabrrinnaaa

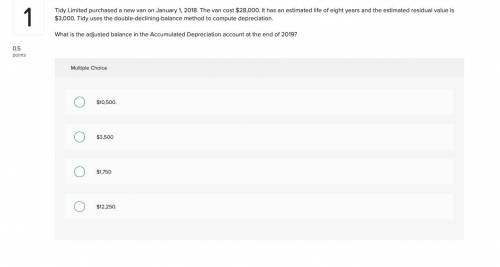

Tidy Limited purchased a new van on January 1, 2018. The van cost $28,000. It has an estimated life of eight years and the estimated residual value is $3,000. Tidy uses the double-declining-balance method to compute depreciation. What is the adjusted balance in the Accumulated Depreciation account at the end of 2019?

Answers: 3

Another question on Business

Business, 22.06.2019 20:00

What part of the rational model of decision-making does the former business executive “elliott” have a problem completing?

Answers: 2

Business, 23.06.2019 00:00

The undress company produces a dress that women use to quickly and easily change in public. the company is just over a year old and has been successful through a kickstarter campaign. the undress company has identified a customer segment, but if it wants to reach a larger customer segment market outside of the kickstarter family, what question must it answer?

Answers: 1

Business, 23.06.2019 00:30

Emerson has an associate degree based on the chart below how will his employment opportunities change from 2008 to 2018

Answers: 3

Business, 23.06.2019 08:30

In the supply-and-demand schedule shown above, the equilibrium price for cell phones is $25 $100 $200

Answers: 2

You know the right answer?

Tidy Limited purchased a new van on January 1, 2018. The van cost $28,000. It has an estimated life...

Questions

Mathematics, 25.03.2021 20:10

Mathematics, 25.03.2021 20:10

History, 25.03.2021 20:10

English, 25.03.2021 20:10

Mathematics, 25.03.2021 20:10

Mathematics, 25.03.2021 20:10

English, 25.03.2021 20:10