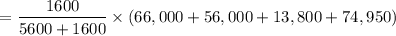

Finch Modems has excess production capacity and is considering the possibility of making and selling paging equipment. The following estimates are based on a production and sales volume of 1,600 pagers. Unit-level manufacturing costs are expected to be $26. Sales commissions will be established at $1.60 per unit. The current facility-level costs, including depreciation on manufacturing equipment ($66,000), rent on the manufacturing facility ($56,000), depreciation on the administrative equipment ($13,800), and other fixed administrative expenses ($74,950), will not be affected by the production of the pagers. The chief accountant has decided to allocate the facility-level costs to the existing product (modems) and to the new product (pagers) on the basis of the number of units of product made (i. e., 5,600 modems and 1,600 pagers). Required a. Determine the per-unit cost of making and selling 1,600 pagers. (Do not round intermediate calculations. Round your answer to 3 decimal places.) b. Assuming the pagers could be sold at a price of $40 each, should Finch make the pagers

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Goods and services that can be used for the same purpose are and goods and services that are used together are

Answers: 1

Business, 21.06.2019 20:50

Your goal is to have $2,000,000. you have a total of $40,000 today. you invest the $40,000 and want to add to it each month. at 10% annual interest, how much do you need to invest each month in order to bring the total up to $2,000,000 30 years from now?

Answers: 2

Business, 22.06.2019 04:30

What is the second step in communication planning? determine the purpose of the message outline the communication for delivery determine the best channel of communication clarify objectives identify the audience

Answers: 2

Business, 22.06.2019 07:30

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

You know the right answer?

Finch Modems has excess production capacity and is considering the possibility of making and selling...

Questions

Biology, 19.06.2020 17:57

Mathematics, 19.06.2020 17:57

Law, 19.06.2020 17:57

Mathematics, 19.06.2020 17:57

Chemistry, 19.06.2020 17:57

Computers and Technology, 19.06.2020 17:57

Mathematics, 19.06.2020 17:57

Computers and Technology, 19.06.2020 17:57

= $ 131.71

= $ 131.71