Business, 18.03.2021 01:20 debnkids691

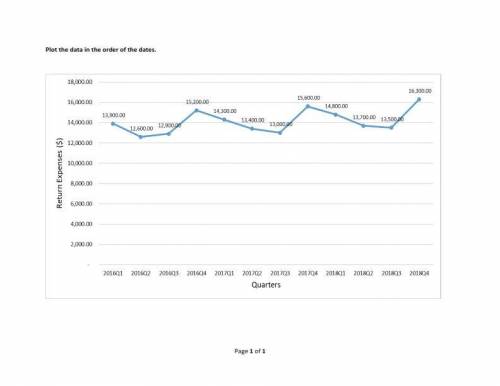

Lexon Inc. is a large manufacturer of affordable DVD players. Management recently became aware of rising expenses resulting from returns of malfunctioning products. As a starting point for further analysis, Paige Jennings, the controller, wants to test different forecasting methods and then use the best one to forecast quarterly expenses for 2019. The relevant quarterly data for the previous three years follow:

2016 Return 2017 Return 2018 Return

Quarter Expenses Quarter Expenses Quarter Expenses

1 $13,900 1 14,300 1 $14,800

2 12,600 2 13,400 2 13,700

3 12,900 3 13,000 3 13,500

4 15,200 4 15,600 4 16,300

The result of a simple regression analysis using all 12 data points yielded an intercept of $13,154.55 and a coefficient for the independent variable of $145.45. (R-squared = 0.44, SE= $974).

Required:

Plot the data in the order of the dates.

Answers: 2

Another question on Business

Business, 22.06.2019 06:10

P11.2a (lo 2, 4) fechter corporation had the following stockholders’ equity accounts on january 1, 2020: common stock ($5 par) $500,000, paid-in capital in excess of par—common stock $200,000, and retained earnings $100,000. in 2020, the company had the following treasury stock transactions. journalize and post treasury stock transactions, and prepare stockholders’ equity section. mar. 1 purchased 5,000 shares at $8 per share. june 1 sold 1,000 shares at $12 per share. sept. 1 sold 2,000 shares at $10 per share. dec. 1 sold 1,000 shares at $7 per share. fechter corporation uses the cost method of accounting for treasury stock. in 2020, the company reported net income of $30,000. instructions a. journalize the treasury stock transactions, and prepare the closing entry at december 31, 2020, for net income. b. open accounts for (1) paid-in capital from treasury stock, (2) treasury stock, and (3) retained earnings. (post to t-accounts.) c. prepare the stockholders’ equity section for fechter corporation at december 31, 2020.

Answers: 1

Business, 22.06.2019 09:40

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 22.06.2019 18:00

Match the different financial task to their corresponding financial life cycle phases

Answers: 3

Business, 22.06.2019 20:20

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

You know the right answer?

Lexon Inc. is a large manufacturer of affordable DVD players. Management recently became aware of ri...

Questions

Mathematics, 28.11.2021 03:40

Biology, 28.11.2021 03:40

Advanced Placement (AP), 28.11.2021 03:40

Biology, 28.11.2021 03:50

History, 28.11.2021 03:50

Engineering, 28.11.2021 03:50

Mathematics, 28.11.2021 03:50

Mathematics, 28.11.2021 03:50

Mathematics, 28.11.2021 03:50

Chemistry, 28.11.2021 03:50

Mathematics, 28.11.2021 03:50