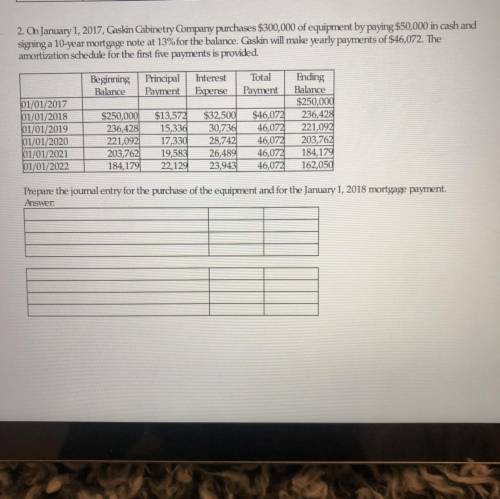

2. On January 1, 2017, Gaskin Cabinetry Company purchases $300,000 of equipment by paying $50,000 in cash and

signing a 10-year mortgage note at 13% for the balance. Gaskin will make yearly payments of $46,072. The

amortization schedule for the first five payments is provided.

01/01/2017

01/01/2018

01/01/2019

01/01/2020

01/01/2021

01/01/2022

Beginning Principal Interest Total Ending

Balance Payment Expense Payment Balance

$250,000

$250,000 $13,572 $32,500 $46,072 236,428

236,428 15,336 30,736 46,072 221,092

221,092 17,330 28,742 46,072 203,762

203,762 19,583 26,489

46,072 184,179

184,179 22,129 23,943 46,072 162,050

Prepare the journal entry for the purchase of the equipment and for the January 1, 2018 mortgage payment.

Answer.

Answers: 1

Another question on Business

Business, 22.06.2019 02:00

Keshawn used to work for an it company in baltimore, but lost his job when his company decided to use workers in new delhi instead. this is an example of:

Answers: 1

Business, 22.06.2019 03:00

5. profit maximization and shutting down in the short run suppose that the market for polos is a competitive market. the following graph shows the daily cost curves of a firm operating in this market. 0 2 4 6 8 10 12 14 16 18 20 50 45 40 35 30 25 20 15 10 5 0 price (dollars per polo) quantity (thousands of polos) mc atc avc for each price in the following table, calculate the firm's optimal quantity of units to produce, and determine the profit or loss if it produces at that quantity, using the data from the previous graph to identify its total variable cost. assume that if the firm is indifferent between producing and shutting down, it will produce. (hint: you can select the purple points [diamond symbols] on the previous graph to see precise information on average variable cost.) price quantity total revenue fixed cost variable cost profit (dollars per polo) (polos) (dollars) (dollars) (dollars) (dollars) 12.50 135,000 27.50 135,000 45.00 135,000 if the firm shuts down, it must incur its fixed costs (fc) in the short run. in this case, the firm's fixed cost is $135,000 per day. in other words, if it shuts down, the firm would suffer losses of $135,000 per day until its fixed costs end (such as the expiration of a building lease). this firm's shutdown price—that is, the price below which it is optimal for the firm to shut down—is per polo.

Answers: 3

Business, 22.06.2019 09:40

Henry crouch's law office has traditionally ordered ink refills 55 units at a time. the firm estimates that carrying cost is 35% of the $11 unit cost and that annual demand is about 240 units per year. the assumptions of the basic eoq model are thought to apply. for what value of ordering cost would its action be optimal? a) for what value of ordering cost would its action be optimal?

Answers: 2

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

You know the right answer?

2. On January 1, 2017, Gaskin Cabinetry Company purchases $300,000 of equipment by paying $50,000 in...

Questions

English, 25.10.2020 14:20

Mathematics, 25.10.2020 14:20

Biology, 25.10.2020 14:20

English, 25.10.2020 14:20

History, 25.10.2020 14:20

Biology, 25.10.2020 14:20

Advanced Placement (AP), 25.10.2020 14:20

Mathematics, 25.10.2020 14:30

English, 25.10.2020 14:30

Mathematics, 25.10.2020 14:30