PLSSS PLSS IM BEGGING YOU GUYS HELP ME.

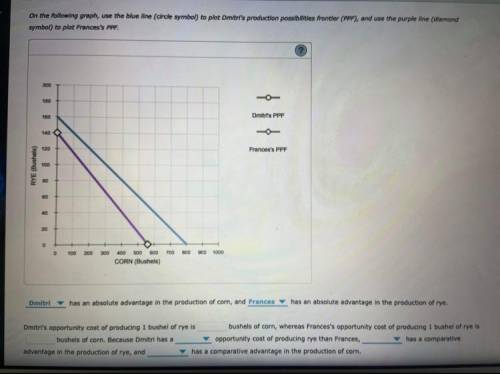

___ (Frances/Dimitri) has an absolute advantage in the production of corn, and ___ (Frances/Dimitri) has an absolute advantage in the production of rye.

Dmitri's opportunity cost of producing 1 bushel of rye is ___ bushels of corn, whereas Frances's opportunity cost of producing 1 bushel of rye is __ bushels of corn. Because Dmitri has a ___(higher/lower) opportunity cost of producing rye than Frances,_(Frances/Dimitri) has a comparative advantage in the production of rye, and ___ (FRANCES/DIMITRI) has a comparative advantage in the production of corn.

Answers: 3

Another question on Business

Business, 22.06.2019 04:00

You are thinking of making your mansion more energy efficient by replacing some of the light bulbs with compact fluorescent bulbs, and insulating part or all of your exterior walls. each compact fluorescent light bulb costs $4 and saves you an average of $2 per year in energy costs, and each square foot of wall insulation costs $1 and saves you an average of $0.20 per year in energy costs.† your mansion has 150 light fittings and 3000 sq ft of uninsulated exterior wall. to impress your friends, you would like to spend as much as possible, but save no more than $750 per year in energy costs (you are proud of your large utility bills). how many compact fluorescent light bulbs and how many square feet of insulation should you purchase? how much will you save in energy costs per year? (if an answer does not exist, enter dne.)

Answers: 1

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

Business, 23.06.2019 07:50

Your company is starting a new r& d initiative: a development of a new drug that dramatically reduces the addiction to smoking. the expert team estimates the probability of developing the drug succesfully at 60% and a chance of losing the investment of 40%. if the project is successful, your company would earn profits (after deducting the investment) of 9,000 (thousand usd). if the development is unsuccessful, the whole investment will be lost -1,000 (thousand usd). your company's risk preference is given by the expected utility function: u(x) v1000 +x, where x is the monetary outcome of a project. calculate the expected profit of the project . calculate the expected utility of the project . find the certainty equivalent of this r& d initiative . find the risk premium of this r& d initiative e is the company risk-averse, risk-loving or risk-neutral? why do you think so?

Answers: 3

Business, 23.06.2019 17:00

Two firms, a and b, each currently emit 100 tons of chemicals into the air. the government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution emitted into the air. the government gives each firm 40 pollution permits, which it can either use or sell to the other firm. it costs firm a $200 for each ton of pollution that it eliminates before it is emitted into the air, and it costs firm b $100 for each ton of pollution that it eliminates before it is emitted into the air. after the two firms buy or sell pollution permits from each other, we would expect that firm a will emit a. 100 fewer tons of pollution into the air, and firm b will emit 20 fewer tons of pollution into the air. b. 20 more tons of pollution into the air, and firm b will emit 100 fewer tons of pollution into the air. c. 50 fewer tons of pollution into the air, and firm b will emit 50 fewer tons of pollution into the air. d. 20 fewer tons of pollution into the air, and firm b will emit 100 fewer tons of pollution into the air.

Answers: 3

You know the right answer?

PLSSS PLSS IM BEGGING YOU GUYS HELP ME.

___ (Frances/Dimitri) has an absolute advantage in the prod...

Questions

Biology, 08.10.2019 05:10

Chemistry, 08.10.2019 05:10

Mathematics, 08.10.2019 05:10

Mathematics, 08.10.2019 05:10

Mathematics, 08.10.2019 05:10