Business, 05.03.2021 09:30 elitehairnerd1964

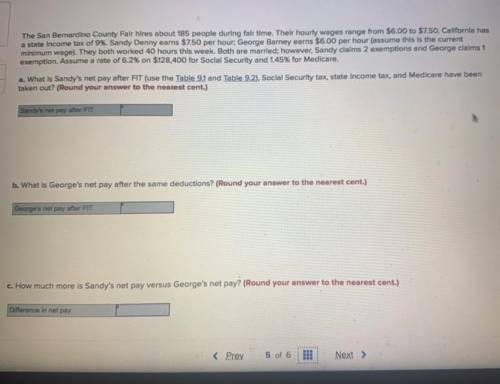

PLEASE HELP !! The San Bernardino County Fair hires about 185 people during falr time. Thelr hourly wages range from $6.00 to $7.50. Callfornla has

a state income tax of 9%. Sandy Denny earns $7.50 per hour, George Barney earns $6.00 per hour (assume this is the current

minimum wage). They both worked 40 hours this week. Both are married; however, Sandy claims 2 exemptions and George claims 1

exemption. Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare.

a. What is Sandy's net pay after FIT (use the Table 9.1 and Table 9.2), Social Security tax, state income tax, and Medicare have been

taken out? (Round your answer to the nearest cent.)

Sandy's not pay after FIT

b. What is George's net pay after the same deductions? (Round your answer to the nearest cent.)

George's net pay after FIT

c. How much more is Sandy's net pay versus George's net pay? (Round your answer to the nearest cent.)

Difference in net pay

Answers: 2

Another question on Business

Business, 22.06.2019 13:50

The retained earnings account has a credit balance of $24,650 before closing entries are made. if total revenues for the period are $77,700, total expenses are $56,900, and dividends are $13,050, what is the ending balance in the retained earnings account after all closing entries are made?

Answers: 2

Business, 22.06.2019 15:00

(a) what do you think will happen if the price of non-gm crops continues to rise? why? (b) what will happen if the price of non-gm food drops? why?

Answers: 2

Business, 22.06.2019 18:00

Interpreting the income tax expense footnote the income tax footnote to the financial statements of fedex corporation follows. the components of the provision for income taxes for the years ended may 31 were as follows: ($ millions) 2010 2009 2008 current provision domestic federal $ 36 $ (35) $ 514 state and local 54 18 74 foreign 207 214 242 297 197 830 deferred provisions (benefit) domestic federal 408 327 31 state and local 15 48 (2) foreign (10) 7 32 413 382 61 provision for income taxes $ 710 $ 579 $ 891 (a)what is the amount of income tax expense reported in fedex's 2010, 2009, and 2008 income statements?

Answers: 2

Business, 22.06.2019 19:50

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

You know the right answer?

PLEASE HELP !! The San Bernardino County Fair hires about 185 people during falr time. Thelr hourly...

Questions

Mathematics, 06.10.2019 10:02

Mathematics, 06.10.2019 10:02

Mathematics, 06.10.2019 10:02

Geography, 06.10.2019 10:02

Mathematics, 06.10.2019 10:02

Mathematics, 06.10.2019 10:02

History, 06.10.2019 10:02

Mathematics, 06.10.2019 10:02

Business, 06.10.2019 10:02

History, 06.10.2019 10:02

Mathematics, 06.10.2019 10:02