Business, 02.03.2021 04:50 whatsupp123

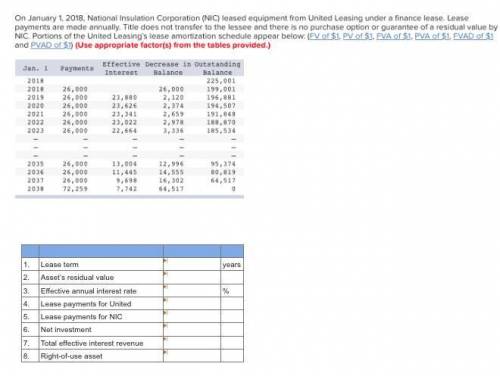

On january 1, 2018, national insulation corporation (nic) leased equipment from united leasing under a finance lease. lease payments are made annually. title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by nic. portions of the united leasing's lease amortization schedule appear below: jan. 1 payments effective interest decrease in balance outstanding balance 2018 192,501 2018 20,000 20,000 172,501 2019 20,000 17,250 2,750 169,751 2020 20,000 16,975 3,025 166,726 2021 20,000 16,673 3,327 163,399 2022 20,000 16,340 3,660 159,739 2023 20,000 15,974 4,026 155,713 — — — — — — — — — — — — — — — 2035 20,000 7,364 12,636 61,006 2036 20,000 6,101 13,899 47,107 2037 20,000 4,711 15,289

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

Fred smithers, a recent college graduate decided to open his own portable juice bar, smithers smoothies, to wheel around newport beach. you, a trusted friend of fred, are a business major that has also recently graduated and agreed to handle the books for a while to get some practical experience and have a favor that you can ask of fred in the future. given the following five transactions concerning the new venture, prepare the necessary journal entries for the transactions, post the journal entries to appropriate t accounts and prepare a trial balance as of the end of the month in order to answer to the necessary may 2: fred invests $12,000 of his own money to start the new company. this money was obtained from a part-time job working at a legal firm while he was in school. may 3: fred spent $5,100 cash to purchase a refrigerated trailer that he can pull behind his car and set up at the beach. under your advice, fred agrees to place the new asset under an account called "equipment." may 6: fred bought $640 of supplies on account from the flav-o-rite confectioners company. because they will last longer than a single accounting period fred agrees to record them as, "supplies" as per your suggestion. may 13: fred sat on the beach for six hours without a single sale and was feeling very down. right before he left, however, a plumber escorting his family reunion along the beach stopped by his stand and bought $800 worth of smoothies for the entire family. under your advice, fred agrees to call this cash revenue, "sales." may 15: excited about his new venture, fred withdraws $350 from the company to take his girlfriend out to dinner. what would be the balance in the cash account at the end of the period following the posting of all the transactions?

Answers: 2

Business, 22.06.2019 13:30

After successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of schenkel enterprises. unfortunately, you will be the only person voting for you. the company has 375,000 shares outstanding, and the stock currently sells for $40, if there are four seats in the current election, how much will it cost you to buy a seat?

Answers: 2

Business, 22.06.2019 18:50

Retirement investment advisors, inc., has just offered you an annual interest rate of 4.4 percent until you retire in 40 years. you believe that interest rates will increase over the next year and you would be offered 5 percent per year one year from today. if you plan to deposit $13,000 into the account either this year or next year, how much more will you have when you retire if you wait one year to make your deposit?

Answers: 3

Business, 23.06.2019 17:00

Ann and jack have been partners for several years. their​ firm, a​ & j tax​ preparation, has been very​ successful, as the pair agree on most​ business-related questions. one​ disagreement, however, concerns the legal form of their business. for the past two​ years, ann has tried to convince jack to incorporate. she believes that there is no downside to incorporating and sees only benefits. jack strongly​ disagrees; he thinks that the business should remain a partnership forever. ​ first, take​ ann's side, and explain the positive side to incorporating the business. ​ next, take​ jack's side, and state the advantages to remaining a partnership. ​ lastly, what information would you want if you were asked to make the decision for ann and​ jack? which of the following statements are the advantages of a partnership compared to a​ corporation? ​(choose all that​ apply.) a. less expensive to organize. b. ownership is readily transferable. c. lower income taxes. d. owners have limited liability. e. long life of firm.

Answers: 2

You know the right answer?

On january 1, 2018, national insulation corporation (nic) leased equipment from united leasing under...

Questions

History, 05.07.2021 14:20

Mathematics, 05.07.2021 14:20

Mathematics, 05.07.2021 14:20

Computers and Technology, 05.07.2021 14:20

Computers and Technology, 05.07.2021 14:20

Mathematics, 05.07.2021 14:20

Mathematics, 05.07.2021 14:20

English, 05.07.2021 14:30

English, 05.07.2021 14:30

Mathematics, 05.07.2021 14:30

Mathematics, 05.07.2021 14:30

Mathematics, 05.07.2021 14:40