On January 1, Year 1, Company A (the lessee) entered into an 8-year lease agreement with Company B (the lessor) for industrial equipment. Annual lease payments of $14,378 are payable at the end of each year. Company A's incremental borrowing rate is 7%, and the implicit rate in the lease is 5%, which is known to Company A. On January 1, Year 1, the fair value of the equipment is $125,000 and its estimated useful life is 15 years. Company A depreciates its long-lived assets in accordance with the straight-line depreciation method. At lease commencement date, Company B estimates that the total residual value of the equipment at the end of the lease term will be $47,388. Company A guarantees $40,000 of the residual value of the equipment. However, due to expected high usage of the equipment, Company A estimates that the value of the equipment at the end of the lease term will be only $30,000. Information on present value factors is as follows:

Present value of $1 at 5% for 8 periods0.6768

Present value of $1 at 7% for 8 periods0.5820

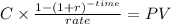

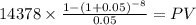

Present value of an annuity of $1 at 5% for 8 periods6.4632

Present value of an annuity of $1 at 7% for 8 periods5.9713

Enter the appropriate amounts in the designated cells. Enter all amounts as positive values. Round all amounts to the nearest whole number. If the amount is zero, enter a zero (0). Enter all percentages as a percentage, not a decimal.

For item 2, select the appropriate lease classification option by Company A from the option list provided.

Item

Amount

1. The discount rate for the lease used by Company A

2. Classification of the lease by Company A

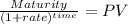

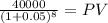

3. The amount at which the lease liability was recognized in Company A's financial statements at the lease commencement date

4. The amount of interest expense recognized by Company A in Year 1

5. The carrying amount of the right-of-use asset in Company A's December 31, Year 1, financial statements

6. The amount of Company A's lease liability on December 31, Year 1, after the first required payment was made

7. The amount of the current portion of the lease liability as it is presented in Company A's December 31, Year 1, financial statements

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

The framers of the us constitution created a system of government that established branches of government set forth the powers of such a branches and placed limits on those powers what are the benefits of such a system? are there any problems associated with such a system?

Answers: 3

Business, 22.06.2019 00:00

When is going to be why would you put money into saving account

Answers: 1

Business, 22.06.2019 01:40

At the local level, the main role of ctsos is to encourage students to become urge them to programs and competitive events. 1. a.interns b.trainees c.members 2. a.participate b.train c.win

Answers: 2

Business, 22.06.2019 08:50

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

You know the right answer?

On January 1, Year 1, Company A (the lessee) entered into an 8-year lease agreement with Company B (...

Questions

Chemistry, 28.09.2019 12:30

Computers and Technology, 28.09.2019 12:30

English, 28.09.2019 12:30

Mathematics, 28.09.2019 12:30

Biology, 28.09.2019 12:30

Biology, 28.09.2019 12:30

Mathematics, 28.09.2019 12:30

Mathematics, 28.09.2019 12:30

Chemistry, 28.09.2019 12:30

Mathematics, 28.09.2019 12:30

English, 28.09.2019 12:30

Mathematics, 28.09.2019 12:30