Business, 26.02.2021 03:50 arthkk0877

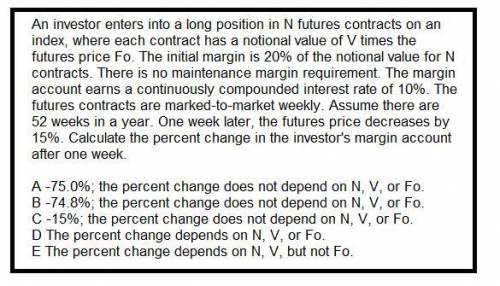

An investor enters into a long position in NN futures contracts on an index, where each contract has a notional value of VV times the futures price F0F0. The initial margin is 20% of the notional value for NN contracts. There is no maintenance margin requirement. The margin account earns a continuously compounded interest rate of 10%. The futures contracts are marked-to-market weekly. Assume there are 52 weeks in a year. One week later, the futures price decreases by 15%. Calculate the percent change in the investor's margin account after one week.

Answers: 3

Another question on Business

Business, 21.06.2019 22:40

The vaska company buys a patent on january 1, year one, and agrees to pay $100,000 per year for the next five years. the first payment is made immediately, and the payments are made on each january 1 thereafter. if a reasonable annual interest rate is 8 percent, what is the recorded value of the patent? 1. $378,4252. $431,2133. $468,9504. $500,000

Answers: 3

Business, 22.06.2019 16:40

Based on what you learned about time management which of these statements are true

Answers: 1

Business, 22.06.2019 21:50

Abus pass costs $5 per week. which of the following equations shows the total cost in dollars, t, of the bus pass for a certain number of weeks, w? t = 5w w = 5t t = 5 + w w = 5 + t

Answers: 3

Business, 22.06.2019 22:30

Which of the following situations is most likely to change a buyer's market into a seller's market? a. a natural disaster that drives away a lot of the population. b. the price of building materials suddenly going up. c. the government buys up a lot of houses to build a new freeway. d. a factory laying off a lot of workers in the area.

Answers: 1

You know the right answer?

An investor enters into a long position in NN futures contracts on an index, where each contract has...

Questions

Chemistry, 17.12.2020 20:40

Mathematics, 17.12.2020 20:40

English, 17.12.2020 20:40

Chemistry, 17.12.2020 20:40

Mathematics, 17.12.2020 20:40

English, 17.12.2020 20:40

Mathematics, 17.12.2020 20:40

Mathematics, 17.12.2020 20:40

Mathematics, 17.12.2020 20:40

Social Studies, 17.12.2020 20:40