Business, 19.02.2021 17:00 jasminelynn135owmyj1

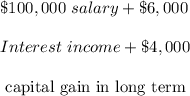

Jeremy earned $100,000 is salary and $6,000 in interest income during the year. Jeremy's employer withheld $11,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of the household and has $23,000 in itemized deductions. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,000. What is Jeremy’s tax refund or tax due including the tax on the capital gain?

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

Conor is 21 years old and just started working after college. he has opened a retirement account that pays 2.5% interest compounded monthly. he plans on making monthly deposits of $200. how much will he have in the account when he reaches 591 years of age?

Answers: 2

Business, 22.06.2019 16:30

On april 1, the cash account balance was $46,220. during april, cash receipts totaled $248,600 and the april 30 balance was $56,770. determine the cash payments made during april.

Answers: 1

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

Business, 22.06.2019 19:00

What is an equation of the line in slope intercept formm = 4 and the y-intercept is (0,5)y = 4x-5y = -5x +4y = 4x + 5y = 5x +4

Answers: 1

You know the right answer?

Jeremy earned $100,000 is salary and $6,000 in interest income during the year. Jeremy's employer wi...

Questions

Chemistry, 27.04.2022 14:00

Mathematics, 27.04.2022 14:00

Social Studies, 27.04.2022 14:00

History, 27.04.2022 14:00

History, 27.04.2022 14:00

Mathematics, 27.04.2022 14:00

SAT, 27.04.2022 14:00

Chemistry, 27.04.2022 14:00

Biology, 27.04.2022 14:00

Mathematics, 27.04.2022 14:00

Engineering, 27.04.2022 14:00

Mathematics, 27.04.2022 14:50

![22\%+ \$6,065] + \$4000\times 15\%](/tpl/images/1130/7036/d5975.png)