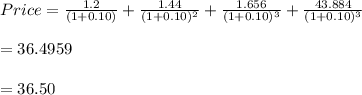

Beachballs, Inc., expects abnormally high earnings for the next three years due to the forecast of unusually hot summers. After the 3-year period, their growth will level off to its normal rate of 6%. Dividends and earnings are expected to grow at 20% for years 1 and 2 and 15% in year 3. The last dividend paid was $1.00. If an investor requires a 10% return on Beachballs, the price she is willing to pay for the stock is closest to:

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

When the federal reserve buys bonds from or sells bonds to member banks, it is called monetary policy reserve ratio interest rate adjustment open market operations

Answers: 1

Business, 22.06.2019 18:00

Carlton industries is considering a new project that they plan to price at $74.00 per unit. the variable costs are estimated at $39.22 per unit and total fixed costs are estimated at $12,085. the initial investment required is $8,000 and the project has an estimated life of 4 years. the firm requires a return of 8 percent. ignore the effect of taxes. what is the degree of operating leverage at the financial break-even level of output?

Answers: 3

Business, 22.06.2019 21:10

An investor purchases 500 shares of nevada industries common stock for $22.00 per share today. at t = 1 year, this investor receives a $0.42 per share dividend (which is not reinvested) on the 500 shares and purchases an additional 500 shares for $24.75 per share. at t = 2 years, he receives another $0.42 (not reinvested) per share dividend on 1,000 shares and purchases 600 more shares for $31.25 per share. at t = 3 years, he sells 1,000 of the shares for $35.50 per share and the remaining 600 shares at $36.00 per share, but receives no dividends. assuming no commissions or taxes, the money-weighted rate of return received on this investment is closest to:

Answers: 3

Business, 22.06.2019 22:30

Perry is a freshman, he estimates that the cost of tuition, books, room and board, transportation, and other incidentals will be $30000 this year. he expects these costs to rise about $1500 each year while he is in college. if it will take him 5 years to earn his bs, what is the present cost of his degree at an interest rate of 6%? if he earns and extra $10000 annually for 40 years, what is the present worth of his degree.?

Answers: 3

You know the right answer?

Beachballs, Inc., expects abnormally high earnings for the next three years due to the forecast of u...

Questions

English, 15.12.2020 01:00

History, 15.12.2020 01:00

Mathematics, 15.12.2020 01:00

History, 15.12.2020 01:00

Mathematics, 15.12.2020 01:00

Mathematics, 15.12.2020 01:00

History, 15.12.2020 01:00

Physics, 15.12.2020 01:00

Arts, 15.12.2020 01:00

Mathematics, 15.12.2020 01:00

Mathematics, 15.12.2020 01:00

Mathematics, 15.12.2020 01:00

Mathematics, 15.12.2020 01:00

Chemistry, 15.12.2020 01:00