Business, 12.02.2021 16:50 melvina13bday

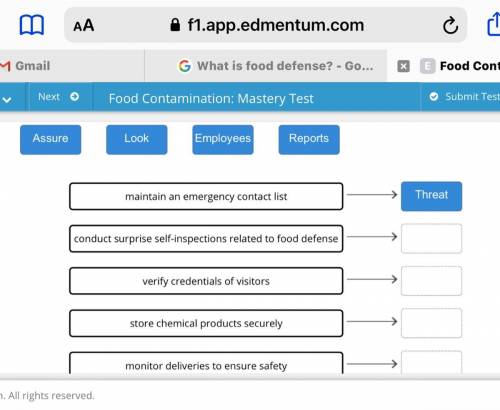

Deliberate Contamination of Food: -Create a safety program A. L.E. R.T

A-Assure safety (ex. Purchasing foods from approved suppliers.)

L-Look after produce (i. e check on the status of your foods )

E-Supervise Employees

R-Maintain Reports;record everything that happens

T-Handle Threats, create an emergency contact list (i. e police, ambulance, pest control, poison control)

Answers: 2

Another question on Business

Business, 21.06.2019 14:50

Calvin works at a facility which processes apples. it costs the facility $0.68 to make either a jar of applesauce or a bottle of apple juice. due to the nature of the process and contractual agreements, calvin's facility must make and sell three jars of applesauce for every two bottles of apple juice. a jar of applesauce sells for $2.20, and a bottle of apple juice sells for $3.15. if the facility has annual overhead costs of $368,500, not including production costs, how many bottles of apple juice will the facility have sold when it breaks even every year? round to the nearest whole bottle, if necessary.

Answers: 3

Business, 21.06.2019 22:40

wilson's has 10,000 shares of common stock outstanding at a market price of $35 a share. the firm also has a bond issue outstanding with a total face value of $250,000 which is selling for 102 percent of face value. the cost of equity is 11 percent while the preminustax cost of debt is 8 percent. the firm has a beta of 1.1 and a tax rate of 34 percent. what is wilson's weighted average cost of capital?

Answers: 3

Business, 22.06.2019 09:00

According to this excerpt, a key part of our national security strategy is

Answers: 2

Business, 22.06.2019 20:10

Russell's is considering purchasing $697,400 of equipment for a four-year project. the equipment falls in the five-year macrs class with annual percentages of .2, .32, .192, .1152, .1152, and .0576 for years 1 to 6, respectively. at the end of the project the equipment can be sold for an estimated $135,000. the required return is 13.2 percent and the tax rate is 23 percent. what is the amount of the aftertax salvage value of the equipment assuming no bonus depreciation is taken

Answers: 2

You know the right answer?

Deliberate Contamination of Food: -Create a safety program A. L.E. R.T

A-Assure safety (ex. Purcha...

Questions

Social Studies, 26.08.2019 13:20

History, 26.08.2019 13:20

Mathematics, 26.08.2019 13:20

Mathematics, 26.08.2019 13:20

Business, 26.08.2019 13:20

Mathematics, 26.08.2019 13:20

Chemistry, 26.08.2019 13:20

Biology, 26.08.2019 13:20

Mathematics, 26.08.2019 13:20

Mathematics, 26.08.2019 13:20

History, 26.08.2019 13:20

Mathematics, 26.08.2019 13:20

Mathematics, 26.08.2019 13:20