Business, 11.02.2021 18:20 rsetser6989

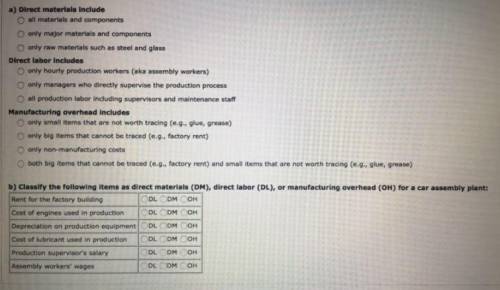

Question 3: Cost terminology in manufacturing firms a) Direct materials include all materials and components only raw materials such as steel and glass only major materials and components Correct: Your answer is correct. Direct labor includes all production labor including supervisors and maintenance staff only managers who directly supervise the production process only hourly production workers (aka assembly workers) Correct: Your answer is correct. Manufacturing overhead includes only big items that cannot be traced (e. g., factory rent) only non-manufacturing costs only small items that are not worth tracing (e. g., glue, grease) both big items that cannot be traced (e. g., factory rent) and small items that are not worth tracing (e. g., glue, grease) Correct: Your answer is correct. b) Classify the following items as direct materials (DM), direct labor (DL), or manufacturing overhead (OH) for a car assembly plant: Rent for the factory building DL DM OH Correct: Your answer is correct. Cost of engines used in production DL DM OH Correct: Your answer is correct. Depreciation on production equipment DL DM OH Correct: Your answer is correct. Cost of lubricant used in production DL DM OH Correct: Your answer is correct. Production supervisor's salary DL DM OH Correct: Your answer is correct. Assembly workers' wages DL DM OH Correct: Your answer is correct.

Answers: 1

Another question on Business

Business, 22.06.2019 07:10

Walsh company manufactures and sells one product. the following information pertains to each of the company’s first two years of operations: variable costs per unit: manufacturing: direct materials $ 25 direct labor $ 12 variable manufacturing overhead $ 5 variable selling and administrative $ 4 fixed costs per year: fixed manufacturing overhead $ 400,000 fixed selling and administrative expenses $ 60,000 during its first year of operations, walsh produced 50,000 units and sold 40,000 units. during its second year of operations, it produced 40,000 units and sold 50,000 units. the selling price of the company’s product is $83 per unit. required: 1. assume the company uses variable costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 2. assume the company uses absorption costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 3. reconcile the difference between variable costing and absorption costing net operating income in year 1.

Answers: 3

Business, 22.06.2019 11:40

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

Business, 22.06.2019 14:00

Wallace company provides the following data for next year: month budgeted sales january $120,000 february 108,000 march 140,000 april 147,000 the gross profit rate is 35% of sales. inventory at the end of december is $29,600 and target ending inventory levels are 10% of next month's sales, stated at cost. what is the amount of purchases budgeted for january?

Answers: 1

Business, 22.06.2019 17:30

Gary lives in an area that receives high rainfall and thunderstorms throughout the year. which device would be useful to him to maintain his computer?

Answers: 2

You know the right answer?

Question 3: Cost terminology in manufacturing firms a) Direct materials include all materials and co...

Questions

Mathematics, 03.03.2020 22:26

Mathematics, 03.03.2020 22:26

Business, 03.03.2020 22:26

Biology, 03.03.2020 22:27

Computers and Technology, 03.03.2020 22:27

Biology, 03.03.2020 22:27

Mathematics, 03.03.2020 22:27

Mathematics, 03.03.2020 22:27

Computers and Technology, 03.03.2020 22:28