Business, 06.02.2021 18:00 kekejones6321

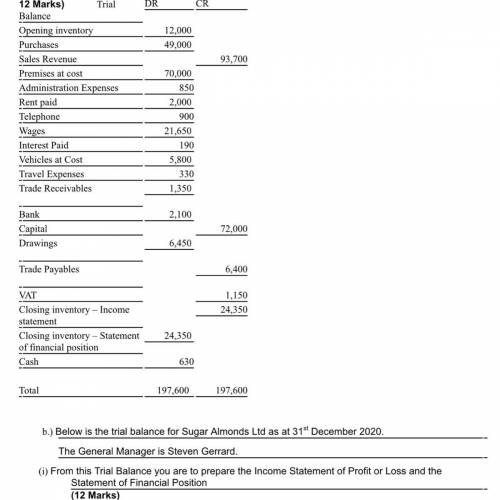

PLEASE HELP DUE SOON!!Using the financial data as appropriate, calculate the following ratios year ending –

(i) Net Profit margin

(ii) Current ratio

(iii) Gearing ratio

(iv) Return on capital employed

(v) Interest Cover ratio

(vi) Gross Profit Margin

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Which of the following best describes how the federal reserve bank banks during a bank run? a. the federal reserve bank regulates exchanges to prevent the demand for withdrawals from rising above the required reserve ratio. b. the federal reserve bank acts as an insurance company that pays customers if their bank fails. c. the federal reserve bank has the power to take over a private bank if customers demand too many withdrawals. d. the federal reserve bank can provide a short-term loan to banks to prevent them from running out of money. 2b2t

Answers: 2

Business, 22.06.2019 01:50

Atlas manufacturing produces a unique valve, and has the capacity to produce 50,000 valves annually. currently atlas produces 40,000 valves and is thinking about increasing production to 45,000 valves next year. what is the most likely behavior of total manufacturing costs and unit manufacturing costs given this change? a. total manufacturing costs will increase and unit manufacturing costs will also increase. b. total manufacturing costs will stay the same and unit manufacturing costs will stay the same. c. total manufacturing costs will increase and unit manufacturing costs will decrease. d. total manufacturing costs will increase and unit manufacturing costs will stay the same.

Answers: 1

Business, 22.06.2019 08:40

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity.calculate the cost of new stock using the dividend growth approach.what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics.each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings.equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

Business, 22.06.2019 18:20

Now ray has had the tires for two months and he notices that the tread has started to pull away from the tire. he has already contacted the place who sold the tires and calmly and accurately explained the problem. they didn’t him because they no longer carry that tire. so he talked with the manager and he still did not get the tire replaced. his consumer rights are being violated. pretend you are ray and write a letter to the company’s headquarters. here are some points to keep in mind when writing the letter: include your name, address, and account number, if appropriate. describe your purchase (name of product, serial numbers, date and location of purchase). state the problem and give the history of how you tried to resolve the problem. ask for a specific action. include how you can be reached.

Answers: 3

You know the right answer?

PLEASE HELP DUE SOON!!Using the financial data as appropriate, calculate the following ratios year e...

Questions

Mathematics, 11.05.2021 03:10

Mathematics, 11.05.2021 03:10

Mathematics, 11.05.2021 03:10

History, 11.05.2021 03:10

Mathematics, 11.05.2021 03:10

Mathematics, 11.05.2021 03:10

Mathematics, 11.05.2021 03:10

Social Studies, 11.05.2021 03:10