Business, 29.08.2019 16:00 dndndndnxmnc

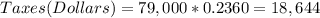

David���s salary totals $79,000 per year. he can expect to pay federal income tax at a rate of 23.60%. how much money will david pay in federal income taxes every year?

a. $60,356

b. $19,110

c. $18,644

d. $22,316

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

If you miss two payments on a credit card what is generally the penalty

Answers: 1

Business, 22.06.2019 18:00

Acountry made education free in mandatory up to age 15. it is established 100 new schools to educate kids across the country. as a result, citizens acquired the _ required to work. the school's generated _ for teachers and other staff. in 20 years, to countryside rapid _ and its gdp.

Answers: 3

Business, 22.06.2019 19:30

Which of the following constitute the types of unemployment occurring at the natural rate of unemployment? a. frictional and cyclical unemployment.b. structural and frictional unemployment.c. cyclical and structural unemployment.d. frictional, structural, and cyclical unemployment.

Answers: 2

Business, 22.06.2019 19:40

You estimate that your cattle farm will generate $0.15 million of profits on sales of $3 million under normal economic conditions and that the degree of operating leverage is 2. (leave no cells blank - be certain to enter "0" wherever required. do not round intermediate calculations. enter your answers in millions.) a. what will profits be if sales turn out to be $1.5 million?

Answers: 3

You know the right answer?

David���s salary totals $79,000 per year. he can expect to pay federal income tax at a rate of 23.60...

Questions

Advanced Placement (AP), 03.03.2021 18:10

History, 03.03.2021 18:10

Mathematics, 03.03.2021 18:10

English, 03.03.2021 18:10

Mathematics, 03.03.2021 18:10

Mathematics, 03.03.2021 18:10

Mathematics, 03.03.2021 18:10

Mathematics, 03.03.2021 18:10

Biology, 03.03.2021 18:10