Business, 01.02.2021 16:30 jasminecoronetti44

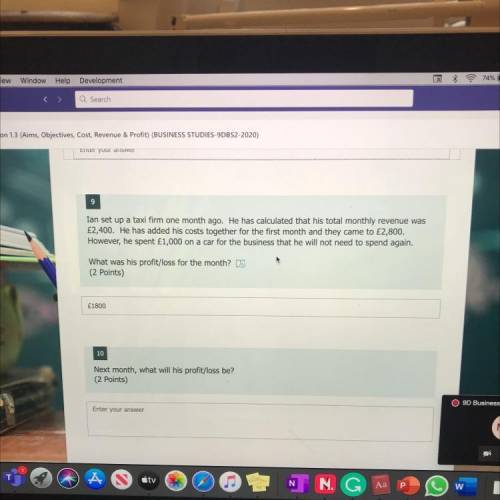

In a live lesson rn. Am studying this rlly messed up stuff, could someone help me wiv this quickly? If it’s correct, I will give brainliest, I swear.

Answers: 1

Another question on Business

Business, 22.06.2019 02:40

Aquatic marine stores company manufactures special metallic materials and decorative fittings for luxury yachts that require highly skilled labor. aquatic uses standard costs to prepare its flexible budget. for the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: direct materials: 3 pounds per unit; $ 6 per pound direct labor: 4 hours per unit; $ 19 per hour during the first quarter, aquatic produced 5 comma 000 units of this product. actual direct materials and direct labor costs were $ 65 comma 000 and $ 330 comma 000, respectively. for the purpose of preparing the flexible budget, calculate the total standard direct materials cost at a production volume of 5 comma 000 units.

Answers: 2

Business, 22.06.2019 20:30

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

Business, 23.06.2019 00:40

In 2017, "a public university was awarded a federal reimbursement grant" of $18 million to carry out research. of this, $12 million was intended to cover direct costs and $6 million to cover overhead. in a particular year, the university incurred $4 million in allowable direct costs and received $3.4 million from the federal government. it expected to incur the remaining costs and collect the remaining balance in 2018. for 2017 it should recognize revenues from the grant of

Answers: 3

Business, 23.06.2019 23:30

Brice is going to purchase a hi-def, flat-screen tv. he has decided on everything except the screen size. the unit with the 42-inch screen costs $600 while the unit with the 47-inch screen costs $750. in making this decision, which concept should brice use? a. time value of money b. marginal tax rates c. marginal utility d. total utilit

Answers: 3

You know the right answer?

In a live lesson rn. Am studying this rlly messed up stuff, could someone help me wiv this quickly?...

Questions

Social Studies, 31.03.2020 19:55

Biology, 31.03.2020 19:55

Social Studies, 31.03.2020 19:55

History, 31.03.2020 19:55

Mathematics, 31.03.2020 19:55

History, 31.03.2020 19:55

Mathematics, 31.03.2020 19:55

Mathematics, 31.03.2020 19:55