Business, 19.01.2021 19:20 abemorales

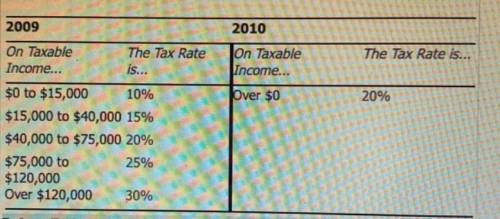

The following table shows the marginal tax rates for unmarried individuals for two years.

2009 2010

On Taxable The Tax Rate On Taxable The Tax Rate is...

Income... is... Income...

$0 to $15,000 10% Over $0 20%

$15,000 to $40,000 15%

$40,000 to $75,000 20%

$75,000 to 25%

$120,000

Over $120,000 30%

Refer to Table: For an individual who earned $35,000 in taxable income in both years, which of the following describes the change in the individual's marginal tax rate between the two years?

a. The marginal tax rate increased from 2009 to 2010.

b. The marginal tax rate decreased from 2009 to 2010.

c. The marginal tax rate remained constant from 2009 to 2010.

d. The change in the marginal tax rate cannot be determined for the two ta schedules shown.

Answers: 3

Another question on Business

Business, 22.06.2019 06:00

Select the correct answer a research organization conducts certain chemical tests on samples. they have data available on the standard results. some of the samples give results outside the boundary of the standard results. which data mining method follows a similar approach? o a. data cleansing ob. network intrusion o c. fraud detection od. customer classification o e. deviation detection

Answers: 1

Business, 22.06.2019 17:00

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Business, 22.06.2019 20:10

Mikkelson corporation's stock had a required return of 12.50% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. then an increase in investor risk aversion caused the market risk premium to rise by 2%. the risk-free rate and the firm's beta remain unchanged. what is the company's new required rate of return? (hint: first calculate the beta, then find the required return.) do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 21:00

On july 2, year 4, wynn, inc., purchased as a short-term investment a $1 million face-value kean co. 8% bond for $910,000 plus accrued interest to yield 10%. the bonds mature on january 1, year 11, and pay interest annually on january 1. on december 31, year 4, the bonds had a fair value of $945,000. on february 13, year 5, wynn sold the bonds for $920,000. in its december 31, year 4, balance sheet, what amount should wynn report for the bond if it is classified as an available-for-sale security?

Answers: 3

You know the right answer?

The following table shows the marginal tax rates for unmarried individuals for two years.

2009 2010...

Questions

Biology, 29.01.2021 05:10

English, 29.01.2021 05:10

Mathematics, 29.01.2021 05:10

Mathematics, 29.01.2021 05:10

English, 29.01.2021 05:10

Mathematics, 29.01.2021 05:10

Chemistry, 29.01.2021 05:10

Mathematics, 29.01.2021 05:10

Mathematics, 29.01.2021 05:10