Business, 18.01.2021 21:00 lelliott86

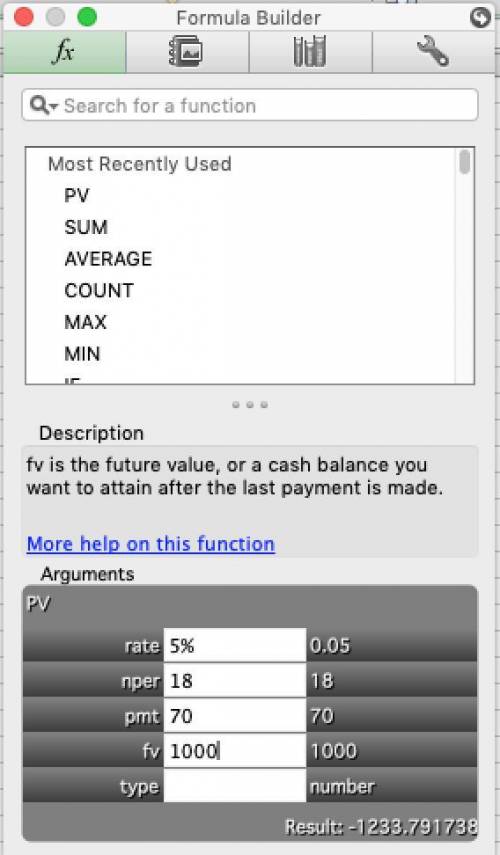

Assume that Bunch Inc. has an issue of 18-year $1,000 par value bonds that pay 7% interest, annually. Further assume that today's expected rate of return on these bonds is 5%. How much would these bonds sell for today

Answers: 2

Another question on Business

Business, 22.06.2019 04:10

What is the difference between secure bonds and naked bonds?

Answers: 1

Business, 22.06.2019 05:30

Financial information that is capable of making a difference in a decision is

Answers: 3

Business, 22.06.2019 07:30

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

Business, 22.06.2019 08:50

Dyed-denim corporation is seeking to lower the costs of value creation and achieve a low-cost position. as a result, it plans to move its manufacturing plant from the u.s. to thailand, which based on company research, is the optimal location for production. this strategic move will most likely allow the company to realize

Answers: 3

You know the right answer?

Assume that Bunch Inc. has an issue of 18-year $1,000 par value bonds that pay 7% interest, annually...

Questions

Mathematics, 06.12.2019 04:31

Chemistry, 06.12.2019 04:31

History, 06.12.2019 04:31

Mathematics, 06.12.2019 04:31

English, 06.12.2019 04:31

Mathematics, 06.12.2019 04:31

Biology, 06.12.2019 04:31

Computers and Technology, 06.12.2019 04:31

Mathematics, 06.12.2019 04:31

English, 06.12.2019 04:31