Smith Company had the following on the dates indicated:

12/31/16 12/31/16

Total Assests $60,...

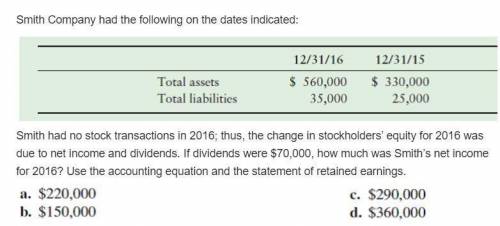

Smith Company had the following on the dates indicated:

12/31/16 12/31/16

Total Assests $60,000 $330,000

Total Liabilities 35,000 25,000

Smith had no stock transactions in 2016; thus, the change in stockholders' equity for 2016 was due to net income and dividends. If dividends were $70,000, how much was Smith's net income for 2016? Use the accounting equation and the statement of retained earnings.

a. $220,000

b. $290,000

c. $150,000

d. $360,000

Answers: 3

Another question on Business

Business, 21.06.2019 17:10

Titus manufacturing, inc. provided the following information for the year: purchases - direct materials $91,000 plant utilities and insurance 68,000 indirect materials 11,170 indirect labor 4270 direct materials used in production 99,000 direct labor 117,500 depreciation on factory plant & equipment 4000the inventory account balances as of january 1 are given below. direct materials $44,000 work-in-progress inventory 10,000 finished goods inventory 50,000what is the ending balance in the direct materials account? $135,000 $36,000 $110,170 $6000

Answers: 3

Business, 22.06.2019 10:00

University car wash built a deluxe car wash across the street from campus. the new machines cost $219,000 including installation. the company estimates that the equipment will have a residual value of $19,500. university car wash also estimates it will use the machine for six years or about 12,500 total hours. actual use per year was as follows: year hours used 1 3,100 2 1,100 3 1,200 4 2,800 5 2,600 6 1,200 prepare a depreciation schedule for six years using the following methods: 1. straight-line. 2. double-declining-balance. 3. activity-based.

Answers: 1

Business, 22.06.2019 10:30

Jack manufacturing company had beginning work in process inventory of $8,000. during the period, jack transferred $34,000 of raw materials to work in process. labor costs amounted to $41,000 and overhead amounted to $36,000. if the ending balance in work in process inventory was $12,000, what was the amount transferred to finished goods inventory?

Answers: 2

Business, 22.06.2019 22:00

In 2018, laureen is currently single. she paid $2,800 of qualified tuition and related expenses for each of her twin daughters sheri and meri to attend state university as freshmen ($2,800 each for a total of $5,600). sheri and meri qualify as laureen’s dependents. laureen also paid $1,900 for her son ryan’s (also laureen’s dependent) tuition and related expenses to attend his junior year at state university. finally, laureen paid $1,200 for herself to attend seminars at a community college to her improve her job skills.what is the maximum amount of education credits laureen can claim for these expenditures in each of the following alternative scenarios? a. laureen's agi is $45,000.b. laureen’s agi is $95,000.c. laureen’s agi is $45,000 and laureen paid $12,000 (not $1,900) for ryan to attend graduate school (i.e, his fifth year, not his junior year).

Answers: 2

You know the right answer?

Questions

History, 24.05.2020 22:57

History, 24.05.2020 22:57

Mathematics, 24.05.2020 22:57

History, 24.05.2020 22:57

Mathematics, 24.05.2020 22:57

Mathematics, 24.05.2020 22:57

Mathematics, 24.05.2020 22:57