Business, 14.01.2021 16:10 lazybridplayer

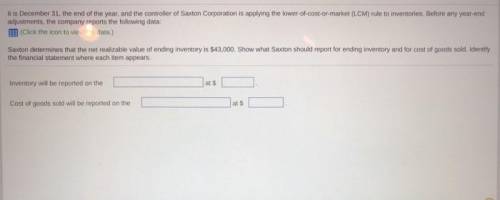

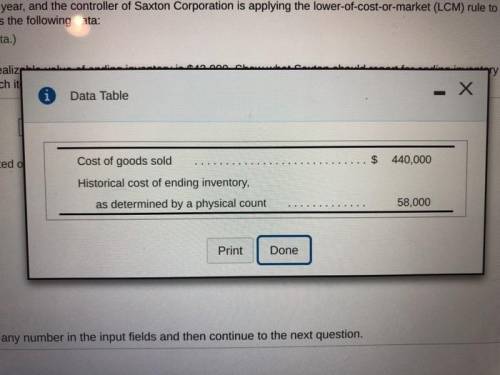

It is December 31, the end of the year, and the controller of Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, reports the following data: Cost of goods sold. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $425,000 Historical cost of ending inventory, as determined by a physical count. . . . . . . . . . . . . 55,000 determines that the current replacement cost of ending inventory is . Show what should report for ending inventory and for cost of goods sold. Identify the financial statement where each item appears.

Answers: 2

Another question on Business

Business, 21.06.2019 14:10

Needs 83,000 optical switches next year (assume same relevant range). by outsourcing them, worldsystems can use its idle facilities to manufacture another product that will contribute $ 140,000 to operating income, but none of the fixed costs will be avoidable. should worldsystems make or buy the switches? show your analysis.

Answers: 3

Business, 21.06.2019 20:30

Which of the following is an example of formal management controls? answers: a firm's culturethe willingness of employees to monitor each otherbudgeting and reporting activitiesmanagerial motivation

Answers: 3

Business, 21.06.2019 21:30

Alandowner entered into a written agreement with a real estate broker whereby the broker would receive a commission of 10% of the sale price if he procured a "ready, willing, and able buyer" for the landowner's property and if the sale actually proceeded through closing. the broker found a buyer who agreed in writing to buy the property from the landowner for $100,000, the landowner's asking price. the buyer put up $6,000 as a down payment. the agreement between the landowner and the buyer contained a liquidated damages clause providing that, if the buyer defaulted by failing to tender the balance due of $94,000 at the closing date, damages would be 10% of the purchase price. the landowner included that clause because she was counting on using the proceeds of the sale for a business venture that would likely net her at least $10,000. the buyer became seriously ill and defaulted. when he recovered, he demanded that the landowner return his $6,000, and the landowner refused. the broker also demanded the $6,000 from the landowner and was refused. the broker and the buyer filed separate suits against the landowner, with the buyer pleading impossibility of performance. the two cases are consolidated into a single case. how should the court rule as to the disposition of the $6,000?

Answers: 3

Business, 22.06.2019 10:00

Your uncle is considering investing in a new company that will produce high quality stereo speakers. the sales price would be set at 1.5 times the variable cost per unit; the variable cost per unit is estimated to be $75.00; and fixed costs are estimated at $1,200,000. what sales volume would be required to break even, i.e., to have ebit = zero?

Answers: 1

You know the right answer?

It is December 31, the end of the year, and the controller of Corporation is applying the lower-of-c...

Questions

Biology, 04.04.2020 08:37

Mathematics, 04.04.2020 08:37

History, 04.04.2020 08:37

Mathematics, 04.04.2020 08:37

Mathematics, 04.04.2020 08:37

Chemistry, 04.04.2020 08:37

English, 04.04.2020 08:37