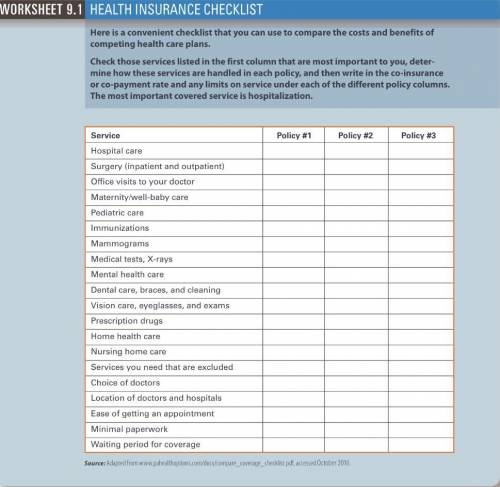

Use Worksheet 9.1. Sylvia Lewis a recent college graduate, has decided to accept a job offer from a nonprofit organization. She’ll earn $34,000 a year but will receive no employee health benefits. Sylvia estimates that her monthly living expenses will be about $2,000 a month, including rent, food, transportation, and clothing. She has no health problems and expects to remain in good health in the near future. Using the Internet or other resources, gather information about three health insurance policies that Sylvia could purchase on her own. Include at least one HMO. Use Worksheet 9.1 to compare the policies’ features. Should Sylvia buy health insurance? Why or why not? Assuming that she does decide to purchase health insurance, which of the three policies would you recommend and why?

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

Which of the following best describes the purpose of raising and lowering the required reserve ratio? a. to make sure that government spending does not result in either a surplus or deficit. b. to stimulate economic growth by making it less expensive for producers to get loans. c. to manage the economy by increasing or decreasing the amount of loans being made. d. to regulate the activity of private banks to assure an equitable distribution of wealth. 2b2t

Answers: 3

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

Business, 22.06.2019 18:00

Biochemical corp. requires $600,000 in financing over the next three years. the firm can borrow the funds for three years at 10.80 percent interest per year. the ceo decides to do a forecast and predicts that if she utilizes short-term financing instead, she will pay 7.50 percent interest in the first year, 12.15 percent interest in the second year, and 8.25 percent interest in the third year. assume interest is paid in full at the end of each year. a)determine the total interest cost under each plan. a) long term fixed rate: b) short term fixed rate: b) which plan is less costly? a) long term fixed rate plan b) short term variable rate plan

Answers: 2

Business, 22.06.2019 19:20

Sanibel autos inc. merged with its competitor vroom autos inc. this allowed sanibel autos to use its technological competencies along with vroom autos' marketing capabilities to capture a larger market share than what the two entities individually held. what type of integration does this scenario best illustrate? a. vertical b. technological c. horizontal d. perfect

Answers: 2

You know the right answer?

Use Worksheet 9.1. Sylvia Lewis a recent college graduate, has decided to accept a job offer from a...

Questions

Social Studies, 04.08.2020 14:01

Geography, 04.08.2020 14:01

Mathematics, 04.08.2020 14:01

Mathematics, 04.08.2020 14:01

Mathematics, 04.08.2020 14:01

Mathematics, 04.08.2020 14:01