Business, 20.12.2020 02:50 tfornwalt4390

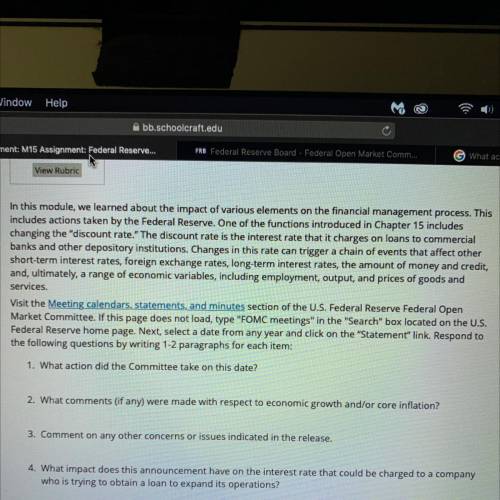

In this module, we learned about the impact of various elements on the financial management process. This

includes actions taken by the Federal Reserve. One of the functions introduced in Chapter 15 includes

changing the "discount rate." The discount rate is the interest rate that it charges on loans to commercial

banks and other depository institutions. Changes in this rate can trigger a chain of events that affect other

short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit,

and, ultimately, a range of economic variables, including employment, output, and prices of goods and

services.

Visit the Meeting calendars, statements, and minutes section of the U. S. Federal Reserve Federal Open

Market Committee. If this page does not load, type "FOMC meetings" in the "Search" box located on the U. S.

Federal Reserve home page. Next, select a date from any year and click on the "Statement" link. Respond to

the following questions by writing 1-2 paragraphs for each item:

1. What action did the Committee take on this date?

2. What comments (if any) were made with respect to economic growth and/or core inflation?

3. Comment on any other concerns or issues indicated in the release.

4. What impact does this announcement have on the interest rate that could be charged to a company

who is trying to obtain a loan to expand its operations?

Answers: 2

Another question on Business

Business, 21.06.2019 22:10

You have just received notification that you have won the $2.0 million first prize in the centennial lottery. however, the prize will be awarded on your 100th birthday (assuming you're around to collect), 66 years from now. what is the present value of your windfall if the appropriate discount rate is 8 percent?

Answers: 1

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 11:40

Manipulation manufacturing's (amm) standards anticipate that there will be 5 pounds of raw material used for every unit of finished goods produced. amm began the month of maymay with 8,000 pounds of raw material, purchased 25,500 pounds for $ 15,300 and ended the month with 7,400 pounds on hand. the company produced 4,9004,900 units of finished goods. the company estimates standard costs at $ 1.10 per pound. the materials price and efficiency variances for the month of maymay were:

Answers: 1

Business, 22.06.2019 12:30

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

You know the right answer?

In this module, we learned about the impact of various elements on the financial management process....

Questions

English, 24.06.2019 19:00

Health, 24.06.2019 19:00

Chemistry, 24.06.2019 19:00

Physics, 24.06.2019 19:00

Mathematics, 24.06.2019 19:00

History, 24.06.2019 19:00

World Languages, 24.06.2019 19:00

Mathematics, 24.06.2019 19:00

Mathematics, 24.06.2019 19:00

Mathematics, 24.06.2019 19:00