Business, 15.12.2020 21:00 naomirice24

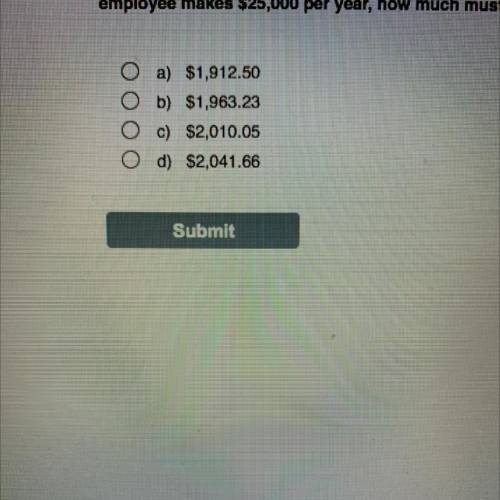

For each employee, you are required to pay 1.45% federal Medicare tax and 6.2% federal Social Security tax. If an employee makes $25,000 per year, how much must you pay in these two taxes?

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

If you were running a company, what are at least two things you could do to improve its productivity.

Answers: 1

Business, 22.06.2019 11:40

Select the correct answer. which is a benefit of planning for your future career? a.being less prepared after high school. b.having higher tuition in college. c.earning college credits in high school. d.ruining your chances of having a successful career.

Answers: 2

Business, 22.06.2019 19:00

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

Business, 22.06.2019 20:10

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

You know the right answer?

For each employee, you are required to pay 1.45% federal Medicare tax and 6.2% federal Social Securi...

Questions

Spanish, 28.06.2019 20:00

English, 28.06.2019 20:00

English, 28.06.2019 20:00

English, 28.06.2019 20:00

Mathematics, 28.06.2019 20:00

English, 28.06.2019 20:00

English, 28.06.2019 20:00

English, 28.06.2019 20:00

Mathematics, 28.06.2019 20:00

Mathematics, 28.06.2019 20:00

History, 28.06.2019 20:00

English, 28.06.2019 20:00