Troy Engines Ltd. manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to produce and sell one type of carburetor to Troy Engines Ltd. for a cost of $55 per unit. To evaluate this offer, Troy Engines Ltd. has gathered the following information relating to its own cost of producing the carburetor internally:

Direct materials cost $34 per unit.

Troy Engines pays its direct labour employees $20 per hour; each carburetor requires 30 minutes of labour time.

Variable manufacturing overhead is allocated at 30% of direct labour cost.

Total fixed manufacturing cost amounts to $15 per unit, of which 60% is allocated common cost and the remaining 40% covers depreciation of special equipment and supervisory salaries. The special equipment has no resale value. Supervisory personnel will be transferred to a different department if the company decides to purchase the carburetor from the outside supplier.

Yearly production of this type of carburetor is 17,000 units.

Required:

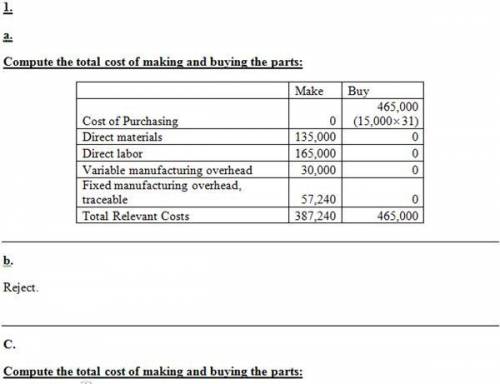

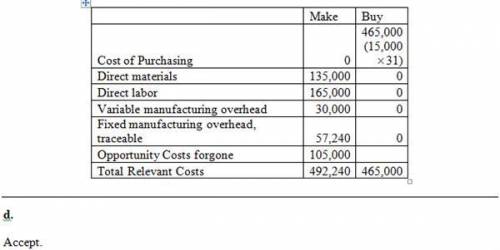

1-a. Assume that the company has no alternative use for the facilities that are now being used to produce the carburetors. Compute the total differential cost per unit for producing and buying the product.

Answers: 2

Another question on Business

Business, 23.06.2019 02:40

Northern lights electronics just completed plans to distribute its new tablet. the product has several unique features that differentiate it from competitor products. the marketing team plans to begin a roll-out with to only one traditional retailer for the first two months. this strategy will give consumers the perception of the product’s stand-out personality and increase demand. marketing will proceed with for the next four months, where it plans to distribute to three other retailers, as well. for the last six months of the year, it will initiate distribution agreements with discount retailers and online retailers, and any other electronics store that wants to carry it. the marketing team is confident that the tablet will cycle through the first three stages of its product life cycle quickly. as the tablet reaches maturity during the second half of its first year in the market, it is good strategy to proceed with as described above. intensive distribution; selective distribution; exclusive distribution exclusive distribution; selective distribution; intensive distribution tertiary level distribution; secondary level distribution; mono-level distribution mono-level distribution; secondary level distribution; tertiary level distribution

Answers: 3

Business, 23.06.2019 02:50

Ll companies has sales of $9,800, net income of $1,060, total assets of $8,950, and total debt of $4,760. assets and costs are proportional to sales. debt and equity are not. a dividend of $371 was paid, and the company wishes to maintain a constant payout ratio. next year's sales are projected to be $10,584. what is the amount of the external financing need?

Answers: 3

Business, 23.06.2019 17:30

The amount that people are willing to pay for each additionally unit of a product or service is the

Answers: 1

Business, 24.06.2019 01:30

Which of the following was developed as a result of the inflation that took place during the 1960s and 1970s? a. stagflation c. automatic stabilizers b. passive fiscal programs d. monetarist point of view

Answers: 1

You know the right answer?

Troy Engines Ltd. manufactures a variety of engines for use in heavy equipment. The company has alwa...

Questions

English, 12.08.2020 04:01

Social Studies, 12.08.2020 04:01

Mathematics, 12.08.2020 04:01

Mathematics, 12.08.2020 04:01

Advanced Placement (AP), 12.08.2020 04:01

Mathematics, 12.08.2020 04:01

Mathematics, 12.08.2020 04:01

Mathematics, 12.08.2020 04:01