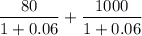

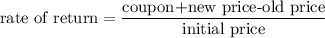

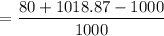

A 2-year maturity bond with face value of $1,000 makes annual coupon payments of $80 and is selling at face value. What will be the rate of return on the bond if its yield to maturity at the end of the year is: (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Rate of Return a. | 6% b. | 8% c. | 10%

Answers: 3

Another question on Business

Business, 22.06.2019 02:00

Benton company (bc), a calendar year entity, has one owner, who is in the 37% federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). bc's gross income is $395,000, and its ordinary trade or business deductions are $245,000. ignore the standard deduction (or itemized deductions) and the deduction for qualified business income. if required, round computations to the nearest dollar. a. bc is operated as a proprietorship, and the owner withdraws $100,000 for personal use. bc's taxable income for the current year is $ , and the tax liability associated with the income from the sole proprietorship is $ . b. bc is operated as a c corporation, pays out $100,000 as salary, and pays no dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . the shareholder's tax liability is $ . c. bc is operated as a c corporation and pays out no salary or dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . d. bc is operated as a c corporation, pays out $100,000 as salary, and pays out the remainder of its earnings as dividends. bc's taxable income for the current year is $ , and bc's tax liability is $ .

Answers: 2

Business, 22.06.2019 10:40

Why do you think the compensation plans differ at the two firms? in particular, why do you think kaufmann’s pays commissions to salespeople, while parkleigh does not? why does parkleigh offer employees discounts on purchases, while kaufmann’s does not?

Answers: 3

Business, 22.06.2019 12:30

M. cotteleer electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. one of the components has an annual demand of 235 units, and this is constant throughout the year. carrying cost is estimated to be $1.25 per unit per year, and the ordering (setup) cost is $21 per order. a) to minimize cost, how many units should be ordered each time an order is placed? b) how many orders per year are needed with the optimal policy? c) what is the average inventory if costs are minimized? d) suppose that the ordering cost is not $21, and cotteleer has been ordering 125 units each time an order is placed. for this order policy (of q = 125) to be optimal, determine what the ordering cost would have to be.

Answers: 1

Business, 22.06.2019 14:30

United continental holdings, inc., (ual), operates passenger service throughout the world. the following data (in millions) were adapted from a recent financial statement of united. sales (revenue) $38,901 average property, plant, and equipment 17,219 average intangible assets 8,883 1. compute the asset turnover. round your answer to two decimal places.

Answers: 2

You know the right answer?

A 2-year maturity bond with face value of $1,000 makes annual coupon payments of $80 and is selling...

Questions

Mathematics, 10.03.2020 07:40

Biology, 10.03.2020 07:40

Mathematics, 10.03.2020 07:40

Advanced Placement (AP), 10.03.2020 07:40

Mathematics, 10.03.2020 07:40

Mathematics, 10.03.2020 07:40

Chemistry, 10.03.2020 07:40

Mathematics, 10.03.2020 07:40

Business, 10.03.2020 07:40

Computers and Technology, 10.03.2020 07:40