Business, 18.11.2020 17:00 arushiverma555

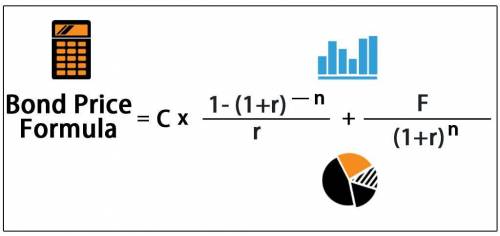

Laurel, Inc., and Hardy Corp. both have 9 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. The Laurel, Inc., bond has four years to maturity, whereas the Hardy Corp. bond has 15 years to maturity.

If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds?(Negative answers should be indicated by a minus sign. Do not round intermediate calculations and round your final answers to 2 decimal places. (e. g., 32.16))

Percentage change in price of Laurel%

Percentage change in price of Hardy%

If interest rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of these bonds be then? (Do not round intermediate calculations and round your final answers to 2 decimal places. (e. g., 32.16))

Percentage change in price of Laurel%

Percentage change in price of Hardy%

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

Match the various steps in the creative process undertaken by the ad agency for developing the campaign for wpu, to the steps in young's model of the creative process.creative process in developing wpu's campaignyoung's modelafter intensive analysis of the data and several rounds of brainstorming, the agency executives decided to take a break from this project (the wpu campaign), and instead work on a different client's project before tackling the wpu project again.using a combination of animatics and storyboards, the ad agency conducted research with a representative sample of sixty target consumers to pretest the campaign theme and the creative execution.during a brainstorming session in the creative department, a copywriter's suggestion for a slogan for wpu was recognized as an excellent central idea that could drive the campaign for wpu.the account planning, account management and creative departments at the ad agency had a series of meetings and brainstorming sessions to discuss the creative brief and the results of all the primary and secondary research done with the target consumers.the account planning and the account management groups at the ad agency conducted primary research with a representative sample of the target segment and also studied secondary research data to gain insights required for the campaign development process.

Answers: 2

Business, 22.06.2019 03:30

Assume that all of thurmond company’s sales are credit sales. it has been the practice of thurmond company to provide for uncollectible accounts expense at the rate of one-half of one percent of net credit sales. for the year 20x1 the company had net credit sales of $2,021,000 and the allowance for doubtful accounts account had a credit balance, before adjustments, of $630 as of december 31, 20x1. during 20x2, the following selected transactions occurred: jan. 20 the account of h. scott, a deceased customer who owed $325, was determined to be uncollectible and was therefore written off. mar. 16 informed that a. nettles, a customer, had been declared bankrupt. his account for $898 was written off. apr. 23 the $906 account of j. kenney & sons was written off as uncollectible. aug. 3 wrote off as uncollectible the $750 account of clarke company. oct. 20 wrote off as uncollectible the $1,130 account of g. michael associates. oct. 27 received a check for $325 from the estate of h. scott. this amount had been written off on january 20 of the current year. dec. 20 cater company paid $7,000 of the $7,500 it owed thurmond company. since cater company was going out of business, the $500 balance it still owed was deemed uncollectible and written off. required: prepare journal entries for the december 31, 20x1, and the seven 20x2 transactions on the work sheets provided at the back of this unit. then answer questions 8 and 9 on the answer sheet. t-accounts are also provided for your use in answering these questions. 8. which one of the following entries should have been made on december 31, 20x1?

Answers: 1

Business, 22.06.2019 13:50

Diamond motor car company produces some of the most luxurious and expensive cars in the world. typically, only a single dealership is authorized to sell its cars in certain major cities. in less populous areas, diamond authorizes a single dealer for an entire state or region. the manufacturer of diamond automobiles is using a(n) distribution strategy for its product.

Answers: 2

Business, 23.06.2019 01:00

Lycan, inc., has 7.5 percent coupon bonds on the market that have 8 years left to maturity. the bonds make annual payments and have a par value of $1,000. if the ytm on these bonds is 9.5 percent, what is the current bond price? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) current bond price

Answers: 2

You know the right answer?

Laurel, Inc., and Hardy Corp. both have 9 percent coupon bonds outstanding, with semiannual interest...

Questions

Mathematics, 03.11.2020 02:20

English, 03.11.2020 02:20

Mathematics, 03.11.2020 02:20

Mathematics, 03.11.2020 02:20

Mathematics, 03.11.2020 02:20

History, 03.11.2020 02:20

Mathematics, 03.11.2020 02:20

Business, 03.11.2020 02:20

Mathematics, 03.11.2020 02:20

Biology, 03.11.2020 02:20

Advanced Placement (AP), 03.11.2020 02:20

Mathematics, 03.11.2020 02:20

English, 03.11.2020 02:20