Business, 16.11.2020 16:40 jack253680

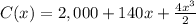

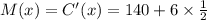

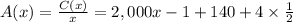

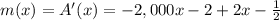

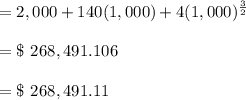

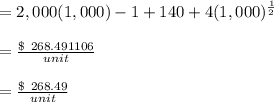

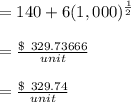

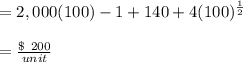

If C(x) is the cost of producing x units of a commodity, then the average cost per unit is c(x) = C(x)/x. Consider the cost function C(x) given below. C(x) = 16,000 + 140x + 4x3/2 (a) Find the total cost at a production level of 1000 units. (Round your answer to the nearest cent.)(b) Find the average cost at a production level of 1000 units. (Round your answer to the nearest cent.) (c) Find the marginal cost at a production level of 1000 units. (Round your answer to the nearest cent.)(d) Find the production level that will minimize the average cost. (Round your answer to the nearest whole number.) (e) What is the minimum average cost? (Round your answer to the nearest dollar.)

Answers: 3

Another question on Business

Business, 22.06.2019 04:30

How does your household gain from specialization and comparative advantage? (what is produced, what is not produced yet paid to a specialist to produce? )

Answers: 3

Business, 22.06.2019 08:30

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

Business, 22.06.2019 20:10

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept,the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year.to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

Business, 23.06.2019 04:40

Aneighborhood home owners association suspects that the recent appraisal values of the houses in the neighborhood conducted by the county government for taxation purposes is too high. it hired a private company to appraise the values of ten houses in the neighborhood. the results, in thousands of dollars, are?

Answers: 1

You know the right answer?

If C(x) is the cost of producing x units of a commodity, then the average cost per unit is c(x) = C(...

Questions

History, 03.02.2020 05:56

Mathematics, 03.02.2020 05:56

History, 03.02.2020 05:56

Chemistry, 03.02.2020 05:56

Social Studies, 03.02.2020 05:56

Spanish, 03.02.2020 05:56

Mathematics, 03.02.2020 05:56

History, 03.02.2020 05:56

Biology, 03.02.2020 05:56

Mathematics, 03.02.2020 05:57

History, 03.02.2020 05:57