On July 1, 2020, Sweet Inc. made two sales.

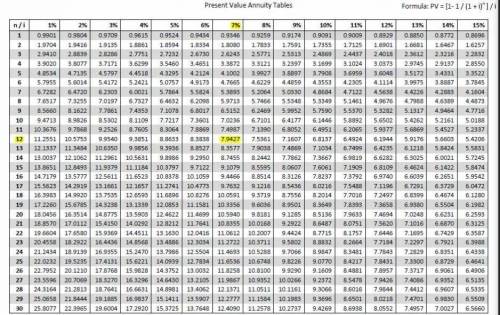

1. It sold land having a fair value of $909,890 in exchange for a 4-year zero-interest-bearing promissory note in the face amount of $1,431,725. The land is carried on Sweet's books at a cost of $594,900.

2. It rendered services in exchange for a 3%, 8-year promissory note having a face value of $409,660 (interest payable annually).

Sweet Inc. recently had to pay 8% interest for money that it borrowed from British National Bank. The customers in these two transactions have credit ratings that require them to borrow money at 12% interest.

Required:

Record the two journal entries that should be recorded by Sweet Inc. for the sales transactions above that took place on July 1, 2020.

Answers: 2

Another question on Business

Business, 21.06.2019 21:20

Vital industries manufactured 2 comma 200 units of its product huge in the month of april. it incurred a total cost of $ 121 comma 000 during the month. out of this $ 121 comma 000, $ 46 comma 000 comprised of direct materials used in the product and the rest was incurred because of the conversion cost involved in the process. ryan had no opening or closing inventory. what will be the total cost per unit of the product, assuming conversion costs contained $ 10 comma 900 of indirect labor?

Answers: 1

Business, 22.06.2019 00:50

At a roundabout, you must yield to a. already in the roundaboutb. entering the roundaboutc. only if their turn signal is ond. only if they honk at you

Answers: 1

Business, 22.06.2019 04:00

Assume that the following conditions exist: a. all banks are fully loaned up- there are no excess reserves, and desired excess reserves are always zero. b. the money multiplier is 5 . c. the planned investment schedule is such that at a 4 percent rate of interest, investment =$1450 billion. at 5 percent, investment is $1420 billion. d. the investment multiplier is 3 . e.. the initial equilibrium level of real gdp is $12 trillion. f. the equilibrium rate of interest is 4 percent now the fed engages in contractionary monetary policy. it sells $1 billion worth of bonds, which reduces the money supply, which in turn raises the market rate of interest by 1 percentage point. calculate the decrease in money supply after fed's sale of bonds: $nothing billion.

Answers: 2

Business, 22.06.2019 19:30

Which of the following occupations relate to a skill category of words and literacy

Answers: 1

You know the right answer?

On July 1, 2020, Sweet Inc. made two sales.

1. It sold land having a fair value of $909,890 in exch...

Questions

Arts, 18.12.2020 17:10

Chemistry, 18.12.2020 17:10

Mathematics, 18.12.2020 17:10

Biology, 18.12.2020 17:10

Chemistry, 18.12.2020 17:10

Biology, 18.12.2020 17:10

History, 18.12.2020 17:10

Mathematics, 18.12.2020 17:10

Arts, 18.12.2020 17:10

SAT, 18.12.2020 17:10