Business, 10.11.2020 01:10 stupidjew5496

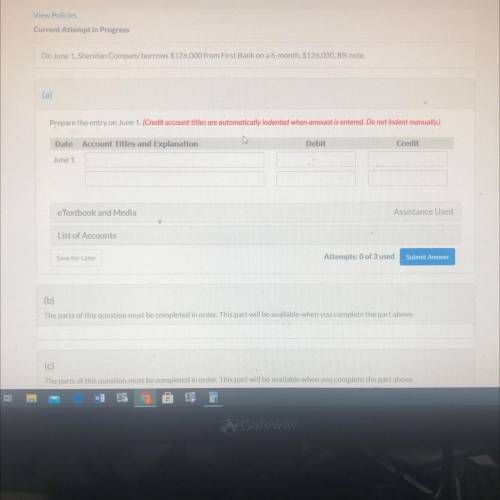

On June 1, Sheridan Company borrows $126,000 from First Bank on a 6-month, $126,000,8% note.

(a)

Prepare the entry on June 1. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Debit

Credit

June 1

e Textbook and Media

Assistance Used

List of Accounts

Save for Later

Attempts: 0 of 3 used

Submit Answer

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

Companies hd and ld are both profitable, and they have the same total assets (ta), total invested capital, sales (s), return on assets (roa), and profit margin (pm). both firms finance using only debt and common equity. however, company hd has the higher total debt to total capital ratio. which of the following statements is correct? a) company hd has a higher assets turnover than company ld. b) company hd has a higher return on equity than company ld. c) none of the other statements are correct because the information provided on the question is not enough. d) company hd has lower total assets turnover than company ld. e) company hd has a lower operating income (ebit) than company ld

Answers: 2

Business, 22.06.2019 12:50

Demand increases by less than supply increases. as a result, (a) equilibrium price will decline and equilibrium quantity will rise. (b) both equilibrium price and quantity will decline. (c) both equilibrium price and quantity will rise

Answers: 3

Business, 22.06.2019 19:40

You estimate that your cattle farm will generate $0.15 million of profits on sales of $3 million under normal economic conditions and that the degree of operating leverage is 2. (leave no cells blank - be certain to enter "0" wherever required. do not round intermediate calculations. enter your answers in millions.) a. what will profits be if sales turn out to be $1.5 million?

Answers: 3

Business, 22.06.2019 20:00

On january 1, year 1, purl corp. purchased as a long-term investment $500,000 face amount of shaw, inc.’s 8% bonds for $456,200. the bonds were purchased to yield 10% interest. the bonds mature on january 1, year 6, and pay interest annually on january 1. purl uses the effective interest method of amortization. what amount (rounded to nearest $100) should purl report on its december 31, year 2, balance sheet for these held-to-maturity bonds?

Answers: 1

You know the right answer?

On June 1, Sheridan Company borrows $126,000 from First Bank on a 6-month, $126,000,8% note.

(a)

Questions

Mathematics, 11.10.2021 14:00

Mathematics, 11.10.2021 14:00

Mathematics, 11.10.2021 14:00

Mathematics, 11.10.2021 14:00

Computers and Technology, 11.10.2021 14:00

Mathematics, 11.10.2021 14:00

Chemistry, 11.10.2021 14:00

Mathematics, 11.10.2021 14:00

Computers and Technology, 11.10.2021 14:00

Chemistry, 11.10.2021 14:00

Mathematics, 11.10.2021 14:00

History, 11.10.2021 14:00

Social Studies, 11.10.2021 14:00