Business, 04.11.2020 18:20 audreymarie2940

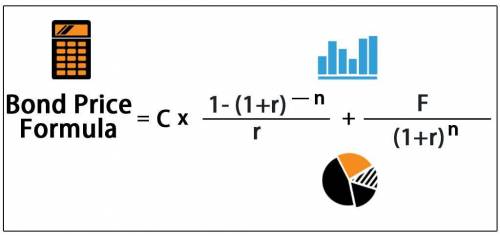

Henley Corporation has bonds on the market with 19.5 years to maturity, a YTM of 11.2 percent, a par value of $1,000, and a current price of $936. The bonds make semiannual payments. What must the coupon rate be on the bonds

Answers: 1

Another question on Business

Business, 21.06.2019 13:40

Conner enterprises issued $120,000 of 10%, 5-year bonds with interest payable semi annually. determine the issue price of the bonds are priced to yield (a) 10%, (b) 8%, and (c) 12%. use financial calculator or excel to calculate answers. round answers to the nearest whole number.

Answers: 3

Business, 22.06.2019 17:30

What is one counter argument to the premise that the wealth gap is a serious problem which needs to be addressed?

Answers: 1

Business, 22.06.2019 20:10

Russell's is considering purchasing $697,400 of equipment for a four-year project. the equipment falls in the five-year macrs class with annual percentages of .2, .32, .192, .1152, .1152, and .0576 for years 1 to 6, respectively. at the end of the project the equipment can be sold for an estimated $135,000. the required return is 13.2 percent and the tax rate is 23 percent. what is the amount of the aftertax salvage value of the equipment assuming no bonus depreciation is taken

Answers: 2

Business, 23.06.2019 09:30

If gerry is approved for a $150,000 mortgage at 3.75 percent interest for a 30-day loan, what would the monthly payment be?

Answers: 1

You know the right answer?

Henley Corporation has bonds on the market with 19.5 years to maturity, a YTM of 11.2 percent, a par...

Questions

Mathematics, 24.02.2021 17:10

English, 24.02.2021 17:10

History, 24.02.2021 17:10

Mathematics, 24.02.2021 17:10

Mathematics, 24.02.2021 17:10

Mathematics, 24.02.2021 17:10

Chemistry, 24.02.2021 17:10

Biology, 24.02.2021 17:10

Spanish, 24.02.2021 17:10

Mathematics, 24.02.2021 17:10

Mathematics, 24.02.2021 17:10

Social Studies, 24.02.2021 17:10