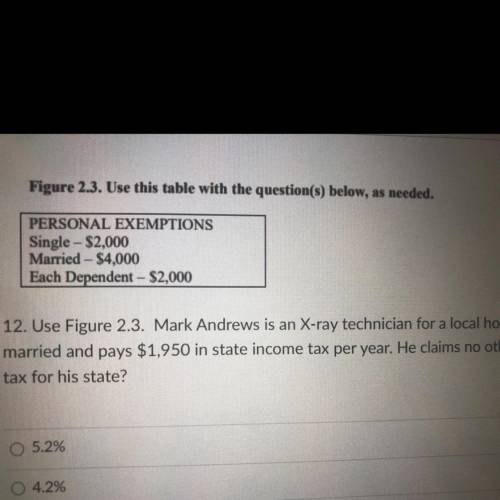

Figure 2.3. Use this table with the question(s) below, as needed.

PERSONAL EXEMPTIONS

Single...

Figure 2.3. Use this table with the question(s) below, as needed.

PERSONAL EXEMPTIONS

Single - $2,000

Married - $4,000

Each Dependent - $2,000

12. Use Figure 2.3. Mark Andrews is an X-ray technician for a local hospital. He earns $43,680 per year. He is

married and pays $1,950 in state income tax per year. He claims no other dependents. What is the state income

tax for his state?

5.2%

4.2%

4.9%

5.9%

Answers: 1

Another question on Business

Business, 22.06.2019 07:10

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u.s. parent on bank deposits held in london d. interest received by a u.s. parent on a loan to a subsidiary in mexico e. principal repayment received by u.s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u.s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 13:10

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

Business, 22.06.2019 23:00

Abeverage company puts game pieces under the caps of its drinks and claims that one in six game pieces wins a prize. the official rules of the contest state that the odds of winning a prize are is the claim "one in six game pieces wins a prize" correct? why or why not? 1: 6.

Answers: 1

You know the right answer?

Questions

Mathematics, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

Social Studies, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

English, 16.10.2020 17:01