Business, 02.11.2020 16:40 lizchavarria863

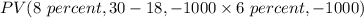

Eighteen years ago a firm issued $1000 par value bonds with a 6% annual coupon rate and a term to maturity of 30 years. Market interest rates have increased since then and par value bonds today would carry an annual coupon rate of 8% (current yield to maturity). What would these bonds sell for today if they made annual coupon payments

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

What preforms the best over the long term? a) bonds b) mutual funds c) stocks d) certificate of deposit

Answers: 2

Business, 22.06.2019 20:30

What could cause a production possibilities curve to move down and to the left? a.) a nation loses land after being defeated in a war. b.) an increase in the use of computer technology speeds up production c.) a baby boom 20 years ago results in a large number of young adults in the population today. d.) thousands of investors from overseas invest money in a nations economy.

Answers: 1

Business, 22.06.2019 23:00

Type of deposit reserve requirementcheckable deposits $7.8 - 48.3 million 3%over $48.3 million 10noncheckable personal savings and time deposits 0refer to the accompanying table. if a bank has $60 million in savings deposits and $40 million in checkable deposits, then its required reserves are$1.2 million.

Answers: 1

Business, 22.06.2019 23:30

Match the different financial tasks to their corresponding financial life cycle phases wealth protection, wealth accumulation and wealth distribution

Answers: 3

You know the right answer?

Eighteen years ago a firm issued $1000 par value bonds with a 6% annual coupon rate and a term to ma...

Questions

Computers and Technology, 14.02.2020 18:06

Mathematics, 14.02.2020 18:06

Chemistry, 14.02.2020 18:07

Computers and Technology, 14.02.2020 18:07

Mathematics, 14.02.2020 18:07

($)

($)

($)

($)