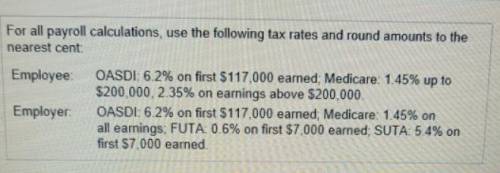

Liam Wallace is general manager of moonwalk salons. during 2016 while this works for the company all year at a $13600 monthly salary he also earned a year end bonus = 15% of his annual salary. Wallace's federal income tax withheld during 2016 was $952 per month plus $3672 on his bonus check. state income tax withheld came to a $150 per month plus $90 on bonuses. FICA tax was withheld on annual earnings. Wallace authorized the following payroll deductions charity fund contribution of 3% of total earnings and life insurance of $50 per month.

1. Compute Wallace's gross pay, payroll deductions, and net pay for the full year 2016. Round all amounts to the nearest dollar

2. Compute Moonwalk's total 2016 payroll expense for Wallace

3. Make the journal entry to record Moonwalk's expense for Wallace's total earnings for the year, his payroll deductions, and net pay. Debit Salaries Expense and Bonus Expense as appropriate. Credit liability accounts for the payroll deductions and Cash for net pay. An explanation is not required

4. Make the journal entry to record the accrual of Moonwalk's payroll tax expense for Wallace's total earnings.

Answers: 3

Another question on Business

Business, 22.06.2019 11:40

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

Business, 22.06.2019 11:50

Which of the following does not offer an opportunity for timely content? evergreen content news alerts content that suits seasonal consumption patterns content that matches a situational trigger content that addresses urgent pain points

Answers: 2

Business, 22.06.2019 18:00

When peter metcalf describes black diamond’s manufacturing facility in china as a “greenfield project,” he means that partnered with a chinese company to buy the plant . of all market entry strategies, this one carries the lowest risk. because black diamond manufactures its outdoor sports products outside the united states, what risks must its managers be aware of?

Answers: 1

Business, 23.06.2019 07:30

Which of the following commission structures creates sales people who are highly motivated to close a sales,because their entire income depends on it?

Answers: 1

You know the right answer?

Liam Wallace is general manager of moonwalk salons. during 2016 while this works for the company all...

Questions

Social Studies, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Chemistry, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Biology, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Arts, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Social Studies, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

Mathematics, 14.09.2020 20:01

English, 14.09.2020 20:01