A 50-kilowatt gas turbine has an investment cost of $40,000. It costs another $14,000 for shipping, insurance, site preparation, fuel lines, and fuel storage tanks. The operation and maintenance expense for this turbine is $450 per year. Additionally, the hourly fuel expense for running the turbine is $7.50 per hour, and the turbine is expected to operate 3,000 hours each year. The cost of dismantling and disposing of the turbine at the end of its 8-year life is $8,000.

Required:

a. If the MARR is 15% per year, what is the annual equivalent life-cycle cost of the gas turbine?

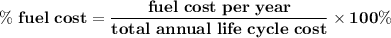

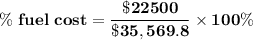

b. What percent of annual life-cycle cost is related to fuel?

Answers: 2

Another question on Business

Business, 21.06.2019 23:00

Employees of dti, inc. worked 1,600 direct labor hours in january and 1,000 direct labor hours in february. dti expects to use 18,000 direct labor hours during the year, and expects to incur $22,500 of worker’s compensation insurance cost for the year. the cash payment for this cost will be paid in april. how much insurance premium should be allocated to products made in january and february?

Answers: 1

Business, 22.06.2019 11:40

On coral island in 2012, the labor force is 12,000, the unemployment rate is 10 percent, and the labor force participation rate is 60 percent. during 2013, 200 unemployed people found jobs and the working-age population increased by 1,000. the total number of people in the labor force did not change. the working-age population at the end of 2013 was the unemployment rate at the end of 2013 was round up to the second decimal. the labor force participation rate at the end of 2013 was round up to the second decimal.

Answers: 1

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 18:30

Hilary works at klothes kloset. she quickly the customers, and her cash drawer is always correct at the end of her shift. however, she never tries to "upsell" the customers (for example, by asking if they would like to purchase earrings to go with the shirt they chose or by suggesting a purse that matches the shoes they are buying). give hilary some constructive feedback on her performance.

Answers: 3

You know the right answer?

A 50-kilowatt gas turbine has an investment cost of $40,000. It costs another $14,000 for shipping,...

Questions

Mathematics, 15.04.2021 19:20

History, 15.04.2021 19:20

Mathematics, 15.04.2021 19:20

Arts, 15.04.2021 19:20

Spanish, 15.04.2021 19:20