Business, 16.10.2020 09:01 zwalkert01

Question 1 (10 points)

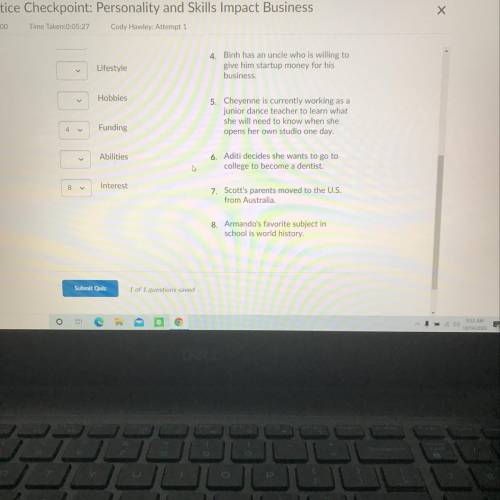

Individual difference matter in business. Entrepreneurs making the most of their

unique characteristics can have an advantage in business. Match the advantage in

Column A with the examples of individual differences in Column B.

1 Yolanda is outgoing and able to

make friends quickly

2 Sergey likes to play soccer in his

Background

Experience

3. Melanie cares about fitness and the

outdoors. She often participates in

active outdoor activities like hiking

and mountain biking

Goals

festyle

4. Binh has an uncle who is willing to

give him startup money for his

business

Hobbies

5. Cheyenne is currently working as a

junior dance teacher to learn what

she will need to know when she

Answers: 1

Another question on Business

Business, 22.06.2019 17:40

Aproduct has a demand of 4000 units per year. ordering cost is $20, and holding cost is $4 per unit per year. the cost-minimizing solution for this product is to order: ? a. 200 units per order. b. all 4000 units at one time. c. every 20 days. d. 10 times per year. e. none of the above

Answers: 3

Business, 22.06.2019 19:50

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

Business, 22.06.2019 21:00

Sue peters is the controller at vroom, a car dealership. dale miller recently has been hired as the bookkeeper. dale wanted to attend a class in excel spreadsheets, so sue temporarily took over dale's duties, including overseeing a fund used for gas purchases before test drives. sue found a shortage in the fund and confronted dale when he returned to work. dale admitted that he occasionally uses the fund to pay for his own gas. sue estimated the shortage at $450. what should sue do?

Answers: 3

Business, 23.06.2019 01:00

Need with an adjusting journal entrycmc records depreciation and amortization expense annually. they do not use an accumulated amortization account. (i.e. amortization expense is recorded with a debit to amort. exp and a credit to the patent.) annual depreciation rates are 7% for buildings/equipment/furniture, no salvage. (round to the nearest whole dollar.) annual amortization rates are 10% of original cost, straight-line method, no salvage. cmc owns two patents: patent #fj101 and patent #cq510. patent #cq510 was acquired on october 1, 2016. patent #fj101 was acquired on april 1, 2018 for $119,000. the last time depreciation & amortization were recorded was december 31, 2017.before adjustment: land: 348791equpment and furniture: 332989building: 876418patents 217000

Answers: 3

You know the right answer?

Question 1 (10 points)

Individual difference matter in business. Entrepreneurs making the most of t...

Questions

Chemistry, 24.08.2019 23:30

Mathematics, 24.08.2019 23:30

History, 24.08.2019 23:30

Geography, 24.08.2019 23:30

Mathematics, 24.08.2019 23:30

Biology, 24.08.2019 23:30

Biology, 24.08.2019 23:30