Flintlnc. provided the following information for the year 2017.

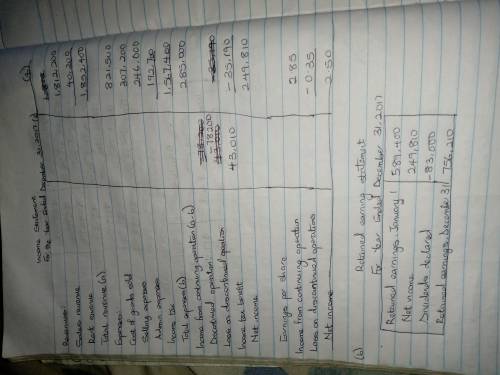

Retained earnings, January 1, 2017 $ 589,400

Administrative expenses 246,000

Selling expenses 307,200

Sales revenue 1,812,200

Cash dividends declared 83,000

Cost of goods sold 821,500

Loss on discontinued operations 78,200

Rent revenue 40,200

Unrealized holding gain on available-for-sale securities 16,900

Income tax applicable to continuing operations 192,700

Income tax benefit applicable to loss on discontinued operations 43,010

Income tax applicable to unrealized holding gain on available-for-sale securities

2,000

1. Prepare a single-step income statement for 2017. Shares outstanding during 2017 were 100,000. (Round earnings per share to 2 decimal places, e. g. $1.48.)

2. Prepare aretained earning statement for 2017. Shares outstanding for 2017 were 100000.

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

Ds unlimited has the following transactions during august. august 6 purchases 58 handheld game devices on account from gamegirl, inc., for $140 each, terms 2/10, n/60. august 7 pays $340 to sure shipping for freight charges associated with the august 6 purchase. august 10 returns to gamegirl three game devices that were defective. august 14 pays the full amount due to gamegirl. august 23 sells 38 game devices purchased on august 6 for $160 each to customers on account. the total cost of the 38 game devices sold is $5,448.51. required: record the transactions of ds unlimited, assuming the company uses a perpetual inventory system. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field. round your answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 08:30

Match the items with the actions necessary to reconcile the bank statement.(there's not just one answer)1. interest credited in bank account2. fee charged by bank for returned check3. checks issued but not deposited4. deposits yet to be crediteda. add to bank statementb. deduct from bank statementc. add to personal statementd. deduct from personal statement

Answers: 2

Business, 22.06.2019 11:50

True or flase? a. new technological developments can us adapt to depleting sources of natural resources. b. research and development funds from the government to private industry never pay off for the country as a whole; they only increase the profits of rich corporations. c. in order for fledgling industries in poor nations to thrive, they must receive protection from foreign trade. d. countries with few natural resources will always be poor. e. as long as real gdp (gross domestic product) grows at a slower rate than the population, per capita real gdp increases.

Answers: 2

Business, 22.06.2019 23:30

Lucido products markets two computer games: claimjumper and makeover. a contribution format income statement for a recent month for the two games appears below: claimjumper makeover total sales $ 30,000 $ 70,000 $ 100,000 variable expenses 20,000 50,000 70,000 contribution margin $ 10,000 $ 20,000 30,000 fixed expenses 24,000 net operating income $ 6,000 required: 1. compute the overall contribution margin (cm) ratio for the company.. 2. compute the overall break-even point for the company in dollar sales. 3. complete the contribution format income statement at break-even point for the company showing the appropriate levels of sales for the two products. (do not round intermediate calculations.)

Answers: 1

You know the right answer?

Flintlnc. provided the following information for the year 2017.

Retained earnings, January 1, 2017...

Questions

Social Studies, 21.07.2019 01:30

Mathematics, 21.07.2019 01:30

Health, 21.07.2019 01:30

Health, 21.07.2019 01:30

Chemistry, 21.07.2019 01:30

Health, 21.07.2019 01:30

History, 21.07.2019 01:30

Health, 21.07.2019 01:30

Mathematics, 21.07.2019 01:30

Health, 21.07.2019 01:30

Social Studies, 21.07.2019 01:30

History, 21.07.2019 01:30

Biology, 21.07.2019 01:30